Page 19 - TOP ONE MATHS F3

P. 19

Top One (MATHS F3) Penerbitan Pelangi Sdn Bhd

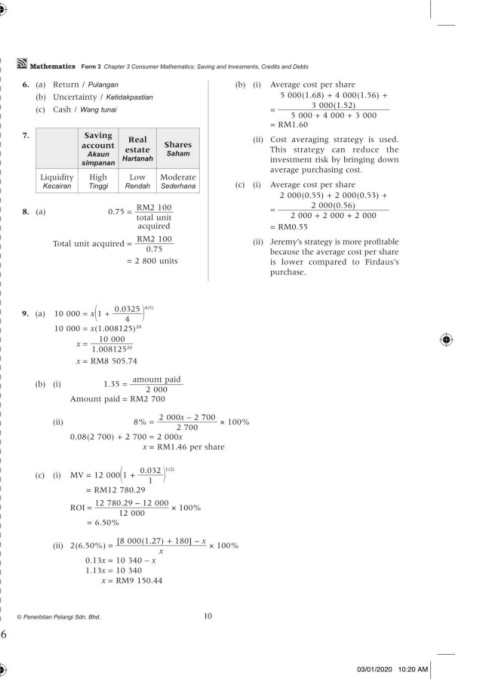

CHAPTER Consumer Mathematics: Saving and Investments, Credits and 6. (a) Return / Pulangan (b) (i) Average cost per share

Mathematics Form 3 Chapter 3 Consumer Mathematics: Saving and Invesments, Credits and Debts

3

5 000(1.68) + 4 000(1.56) +

(b) Uncertainty / Ketidakpastian

Debts

3 000(1.52)

Matematik Pengguna: Simpanan dan Pelaburan, Kredit dan Hutang (c) Cash / Wang tunai = 5 000 + 4 000 + 3 000

= RM1.60

7. Saving Real (ii) Cost averaging strategy is used.

account Shares

1. Akaun estate Saham This strategy can reduce the

Savings Investment Hartanah investment risk by bringing down

Simpanan Pelaburan simpanan average purchasing cost.

Liquidity High Low Moderate

Kecairan Tinggi Rendah Sederhana (c) (i) Average cost per share

2 000(0.55) + 2 000(0.53) +

Fixed deposits Shares Current account Real estates Unit trust RM2 100 2 000(0.56)

Simpanan tetap Saham Simpanan semasa Hartanah Unit amanah saham 8. (a) 0.75 = total unit = 2 000 + 2 000 + 2 000

acquired = RM0.55

RM2 100 (ii) Jeremy’s strategy is more profitable

2. (a) Simple interest, I 0.032 4(3) Total unit acquired = 0.75

1.6 3 3. (a) Matured value = 5 000 1 + 4 because the average cost per share

= RM2 000 × × = 2 800 units is lower compared to Firdaus’s

100 12 = RM5 501.69

= RM8 purchase.

(b) Matured value

Total saving = RM2 000 + RM8

= RM2008 = 15 000 1 + 0.043 1(10)

1

1.8 0.0325 4(5)

(b) Simple interest, I = 3 000 × × 2 = RM22 852.53 9. (a) 10 000 = x 1 +

100 4

= RM108 (c) Matured value 10 000 = x(1.008125)

20

Total saving = RM3 000 + RM108 = 8 000 1 + 0.035 12(7) x = 10 000

= RM3 108 12 1.008125 20

2.2 9 = RM10 217.33 x = RM8 505.74

(c) Simple interest, I = 5 000 × ×

100 12 4. (a) ✓

= RM82.50 amount paid

(b) ✓ (b) (i) 1.35 =

Total saving = RM5 000 + RM82.50 (c) ✗ 2 000

= RM5 082.50 Amount paid = RM2 700

2 000x – 2 700

(ii) 8% = × 100%

2 700

5. (a) Total return = RM7 000 + RM100 – RM6 500 0.08(2 700) + 2 700 = 2 000x

= RM600 x = RM1.46 per share

600

ROI = × 100%

6 500

= 9.23% 0.032 1(2)

(c) (i) MV = 12 000 1 + 1

(b) 12.5% = (13 200 + 2x) – 12 000 × 100% = RM12 780.29

12 000

0.125(12 000) + 12 000 = 13 200 + 2x ROI = 12 780.29 – 12 000 × 100%

2x = 300 12 000

x = RM150 = 6.50%

[8 000(1.27) + 180] – x

RM1 500 – RM2 000 (ii) 2(6.50%) = × 100%

(c) (i) ROI = × 100% x

RM2 000 0.13x = 10 340 – x

= –25%

1.13x = 10 340

x = RM9 150.44

(ii) Change of government policy could cause loss in investment.

9 © Penerbitan Pelangi Sdn. Bhd. © Penerbitan Pelangi Sdn. Bhd. 10

A6

BOOKLET ANS MATH F3.indd 6 03/01/2020 10:20 AM