Page 102 - mutual-fund-insight - Mar 2021_Neat

P. 102

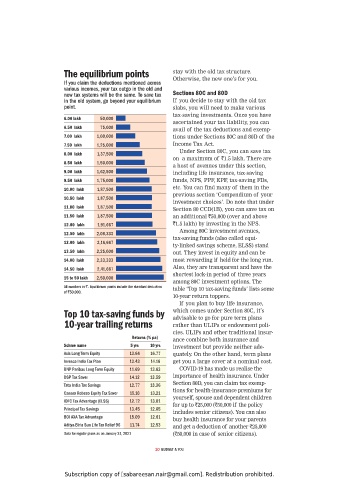

The equilibrium points stay with the old tax structure.

Otherwise, the new one’s for you.

If you claim the deductions mentioned across

various incomes, your tax outgo in the old and

new tax systems will be the same. To save tax Sections 80C and 80D

in the old system, go beyond your equilibrium If you decide to stay with the old tax

point. slabs, you will need to make various

tax-saving investments. Once you have

6.00 lakh 50,000

ascertained your tax liability, you can

6.50 lakh 75,000

avail of the tax deductions and exemp-

7.00 lakh 1,00,000 tions under Sections 80C and 80D of the

7.50 lakh 1,25,000 Income Tax Act.

Under Section 80C, you can save tax

8.00 lakh 1,37,500

on a maximum of `1.5 lakh. There are

8.50 lakh 1,50,000

a host of avenues under this section,

9.00 lakh 1,62,500 including life insurance, tax-saving

9.50 lakh 1,75,000 funds, NPS, PPF, EPF, tax-saving FDs,

10.00 lakh 1,87,500 etc. You can find many of them in the

previous section ‘Compendium of your

10.50 lakh 1,87,500

investment choices’. Do note that under

11.00 lakh 1,87,500

Section 80 CCD(1B), you can save tax on

11.50 lakh 1,87,500 an additional `50,000 (over and above

12.00 lakh 1,91,667 `1.5 lakh) by investing in the NPS.

Among 80C investment avenues,

12.50 lakh 2,08,333

tax-saving funds (also called equi-

13.00 lakh 2,16,667

ty-linked savings scheme, ELSS) stand

13.50 lakh 2,25,000 out. They invest in equity and can be

14.00 lakh 2,33,333 most rewarding if held for the long run.

14.50 lakh 2,41,667 Also, they are transparent and have the

shortest lock-in period of three years

15 to 50 lakh 2,50,000

among 80C investment options. The

All numbers in `. Equilibrium points include the standard deduction table ‘Top 10 tax-saving funds’ lists some

of `50,000.

10-year return toppers.

If you plan to buy life insurance,

Top 10 tax-saving funds by which comes under Section 80C, it’s

advisable to go for pure term plans

10-year trailing returns rather than ULIPs or endowment poli-

cies. ULIPs and other traditional insur-

Returns (% pa)

ance combine both insurance and

Schme name 5 yrs 10 yrs investment but provide neither ade-

Axis Long Term Equity 13.64 16.77 quately. On the other hand, term plans

Invesco India Tax Plan 13.43 14.16 get you a large cover at a nominal cost.

BNP Paribas Long Term Equity 11.69 13.63 COVID-19 has made us realise the

DSP Tax Saver 14.12 13.59 importance of health insurance. Under

Tata India Tax Savings 12.77 13.36 Section 80D, you can claim tax exemp-

Canara Robeco Equity Tax Saver 15.16 13.21 tions for health-insurance premiums for

yourself, spouse and dependent children

IDFC Tax Advantage (ELSS) 12.72 13.01

for up to `25,000 (`50,000 if the policy

Principal Tax Savings 13.45 12.65

includes senior citizens). You can also

BOI AXA Tax Advantage 15.09 12.61

buy health insurance for your parents

Aditya Birla Sun Life Tax Relief 96 11.74 12.53 and get a deduction of another `25,000

Data for regular plans as on January 31, 2021 (`50,000 in case of senior citizens).

10 BUDGET & YOU

Subscription copy of [sabareesan.nair@gmail.com]. Redistribution prohibited.