Page 98 - mutual-fund-insight - Mar 2021_Neat

P. 98

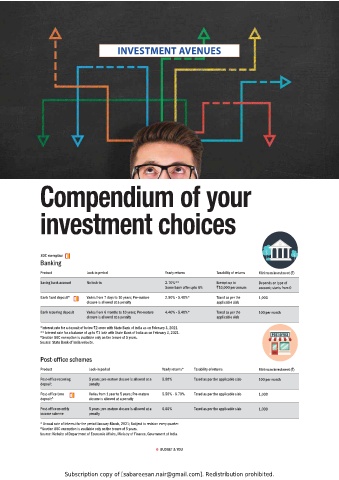

INVESTMENT AVENUES

Compendium of your

investment choices

80C exemption

Banking

Product Lock-in period Yearly returns Taxability of returns Minimum investment (`)

Saving bank account No lock-in 2.70%** Exempt up to Depends on type of

Some bank offer upto 6% `10,000 per annum account; starts from 0

Bank fixed deposit^ Varies from 7 days to 10 years; Pre-mature 2.90% - 5.40%* Taxed as per the 1,000

closure is allowed at a penalty applicable slab

Bank recurring deposit Varies from 6 months to 10 years; Pre-mature 4.40% - 5.40%* Taxed as per the 100 per month

closure is allowed at a penalty applicable slab

*Interest rate for a deposit of below `2 crore with State Bank of India as on February 3, 2021.

** Interest rate for a balance of up to `1 lakh with State Bank of India as on February 3, 2021.

^Section 80C exemption is available only on the tenure of 5 years.

Source: State Bank of India website.

Post-office schemes

Product Lock-in period Yearly returns* Taxability of returns Minimum investment (`)

Post-office recurring 5 years; pre-mature closure is allowed at a 5.80% Taxed as per the applicable slab 100 per month

deposit penalty

Post-office time Varies from 1 year to 5 years; Pre-mature 5.50% - 6.70% Taxed as per the applicable slab 1,000

deposit^ closure is allowed at a penalty

Post-office monthly 5 years; pre-mature closure is allowed at a 6.60% Taxed as per the applicable slab 1,000

income scheme penalty

* Annual rate of interest for the period January-March, 2021; Subject to revision every quarter.

^Section 80C exemption is available only on the tenure of 5 years.

Source: Website of Department of Economic Affairs, Ministry of Finance, Government of India.

6 BUDGET & YOU

Subscription copy of [sabareesan.nair@gmail.com]. Redistribution prohibited.