Page 99 - mutual-fund-insight - Mar 2021_Neat

P. 99

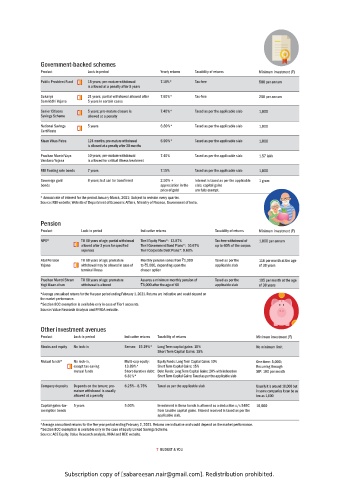

Government-backed schemes

Product Lock-in period Yearly returns Taxability of returns Minimum investment (`)

Public Provident Fund 15 years; pre-mature withdrawal 7.10%* Tax-free 500 per annum

is allowed at a penalty after 5 years

Sukanya 21 years; partial withdrawal allowed after 7.60%* Tax-free 250 per annum

Samriddhi Yojana 5 years in certain cases

Senior Citizens 5 years; pre-mature closure is 7.40%* Taxed as per the applicable slab 1,000

Savings Scheme allowed at a penalty

National Savings 5 years 6.80%* Taxed as per the applicable slab 1,000

Certificate

Kisan Vikas Patra 124 months; pre-mature withdrawal 6.90%* Taxed as per the applicable slab 1,000

is allowed at a penalty after 30 months

Pradhan Mantri Vaya 10 years; pre-mature withdrawal 7.40% Taxed as per the applicable slab 1.57 lakh

Vandana Yojana is allowed for critical illness treatment

RBI floating rate bonds 7 years 7.15% Taxed as per the applicable slab 1,000

Sovereign gold 8 years; but can be transferred 2.50% + Interest is taxed as per the applicable 1 gram

bonds appreciation in the slab; capital gains

price of gold are fully exempt.

* Annual rate of interest for the period January-March, 2021; Subject to revision every quarter.

Source: RBI website; Website of Department of Economic Affairs, Ministry of Finance, Government of India.

Pension

Product Lock-in period Indicative returns Taxability of returns Minimum investment (`)

NPS^ Till 60 years of age; partial withdrawal Tier I Equity Plans*: 13.87% Tax-free withdrawal of 1,000 per annum

allowed after 3 years for specified Tier I Government Bond Plans*: 10.67% up to 60% of the corpus

expenses Tier I Corporate Debt Plans*: 9.60%

Atal Pension Till 60 years of age; premature Monthly pension varies from `1,000 Taxed as per the 116 per month at the age

Yojana withdrawal may be allowed in case of to `5,000, depending upon the applicable slab of 30 years

terminal illness chosen option

Pradhan Mantri Shram Till 60 years of age; premature Assures a minimum monthly pension of Taxed as per the 105 per month at the age

Yogi Maan-dhan withdrawal is allowed `3,000 after the age of 60 applicable slab of 30 years

*Average annualised returns for the five year period ending February 1, 2021. Returns are indicative and would depend on

the market performance.

^Section 80C exemption is available only in case of Tier I accounts.

Source: Value Research Analysis and PFRDA website.

Other investment avenues

Product Lock-in period Indicative returns Taxability of returns Minimum investment (`)

Stocks and equity No lock-in Sensex: 15.19%* Long Term capital gains: 10% No minimum limit

Short Term Capital Gains: 15%

Mutual funds^ No lock-in, Multi-cap equity: Equity Funds: Long Term Capital Gains: 10% One-time: 5,000;

except tax-saving 13.89%* Short Term Capital Gains: 15% Recurring through

mutual funds Short duration debt: Debt Funds: Long Term Capital Gains: 20% with indexation SIP: 100 per month

6.81%* Short Term Capital Gains: Taxed as per the applicable slab

Company deposits Depends on the tenure; pre- 6.25% - 8.75% Taxed as per the applicable slab Usually it is around 10,000 but

mature withdrawal is usually in some companies it can be as

allowed at a penalty low as 1,000

Capital-gains-tax- 5 years 5.00% Investment in these bonds is allowed as a deduction u/s 54EC 10,000

exemption bonds from taxable capital gains. Interest received is taxed as per the

applicable slab.

*Average annualised returns for the five year period ending February 2, 2021. Returns are indicative and would depend on the market performance.

^Section 80C exemption is available only in the case of Equity Linked Savings Scheme.

Source: ACE Equity, Value Research analysis, NHAI and REC website.

7 BUDGET & YOU

Subscription copy of [sabareesan.nair@gmail.com]. Redistribution prohibited.