Page 28 - mutual-fund-insight - Mar 2021_Neat

P. 28

COVER STORY

Ashutosh Gupta, Sneha Suri

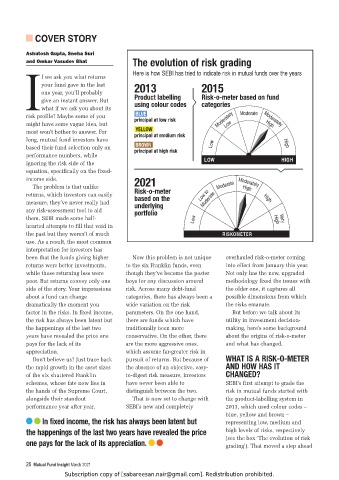

and Omkar Vasudev Bhat ;OL L]VS\[PVU VM YPZR NYHKPUN

Here is how SEBI has tried to indicate risk in mutual funds over the years

f we ask you what returns

your fund gave in the last

one year, you’ll probably

give an instant answer. But 7YVK\J[ SHILSSPUN 9PZR V TL[LY IHZLK VU M\UK

Iwhat if we ask you about its \ZPUN JVSV\Y JVKLZ JH[LNVYPLZ

)3<,

risk profile? Maybe some of you WYPUJPWHS H[ SV^ YPZR Moderately Moderate Moderately

might have some vague idea, but Low High

@,336>

most won’t bother to answer. For WYPUJPWHS H[ TLKP\T YPZR

long, mutual fund investors have

)96>5

based their fund selection only on WYPUJPWHS H[ OPNO YPZR Low High

performance numbers, while

ignoring the risk side of the LOW HIGH

equation, specifically on the fixed-

income side. Moderately

The problem is that unlike Moderate High

returns, which investors can easily 9PZR V TL[LY Low to

IHZLK VU [OL

measure, they’ve never really had \UKLYS`PUN Moderate High

any risk-assessment tool to aid WVY[MVSPV

them. SEBI made some half- Low High Very

hearted attempts to fill that void in

the past but they weren’t of much RISKOMETER

use. As a result, the most common

interpretation for investors has

been that the funds giving higher Now this problem is not unique overhauled risk-o-meter coming

returns were better investments, to the six Franklin funds, even into effect from January this year.

while those returning less were though they’ve become the poster Not only has the new, upgraded

poor. But returns convey only one boys for any discussion around methodology fixed the issues with

side of the story. Your impressions risk. Across many debt-fund the older one, it captures all

about a fund can change categories, there has always been a possible dimensions from which

dramatically the moment you wide variation on the risk the risks emanate.

factor in the risks. In fixed income, parameters. On the one hand, But before we talk about its

the risk has always been latent but there are funds which have utility in investment decision-

the happenings of the last two traditionally been more making, here’s some background

years have revealed the price one conservative. On the other, there about the origins of risk-o-meter

pays for the lack of its are the more aggressive ones, and what has changed.

appreciation. which assume far-greater risk in

Don’t believe us? Just trace back pursuit of returns. But because of >/(; 0: ( 90:2 6 4,;,9

the rapid growth in the asset sizes the absence of an objective, easy- (5+ /6> /(: 0;

of the six shuttered Franklin to-digest risk measure, investors */(5.,+&

schemes, whose fate now lies in have never been able to SEBI’s first attempt to grade the

the hands of the Supreme Court, distinguish between the two. risk in mutual funds started with

alongside their standout That is now set to change with the product-labelling system in

performance year after year. SEBI’s new and completely 2013, which used colour codes –

blue, yellow and brown –

0U MP_LK PUJVTL [OL YPZR OHZ HS^H`Z ILLU SH[LU[ I\[ representing low, medium and

[OL OHWWLUPUNZ VM [OL SHZ[ [^V `LHYZ OH]L YL]LHSLK [OL WYPJL high levels of risks, respectively

VUL WH`Z MVY [OL SHJR VM P[Z HWWYLJPH[PVU (see the box ‘The evolution of risk

grading’). That moved a step ahead

26 Mutual Fund Insight March 2021

Subscription copy of [sabareesan.nair@gmail.com]. Redistribution prohibited.