Page 1135 - How to Make Money in Stocks Trilogy

P. 1135

Selling Checklist 121

Offensive Selling to Lock in Your Profits

A quick note on charts before we jump in.

As we go through the Selling Checklist, I’ll touch on chart-related terms

like “base pattern,” “cup-with-handle,” “ideal buy point” and “proper buying

range.” If you’re not familiar with those concepts, don’t worry. We’re going

through this one step at a time—and we’ll cover all that in due course.

For now, just stay focused on the basic selling game plan: Take most prof-

its at 20%–25%; cut all losses at no more than 7%–8%; and take defensive

action as a market downtrend begins.

We’ll get into chart-based sell signals in Chapter 6, “Don’t Invest Blindly:

Use Charts to See the Right Time to Buy and Sell.”

Selling Checklist

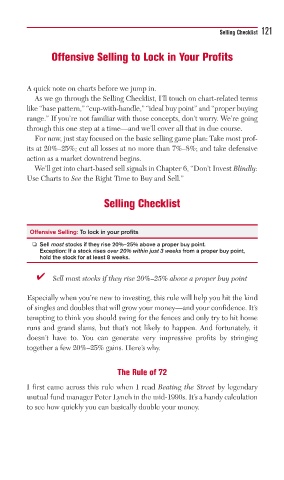

Offensive Selling: To lock in your profits

❏ Sell most stocks if they rise 20%–25% above a proper buy point.

Exception: If a stock rises over 20% within just 3 weeks from a proper buy point,

hold the stock for at least 8 weeks.

■ ✔ Sell most stocks if they rise 20%–25% above a proper buy point

Especially when you’re new to investing, this rule will help you hit the kind

of singles and doubles that will grow your money—and your confidence. It’s

tempting to think you should swing for the fences and only try to hit home

runs and grand slams, but that’s not likely to happen. And fortunately, it

doesn’t have to. You can generate very impressive profits by stringing

together a few 20%–25% gains. Here’s why.

The Rule of 72

I first came across this rule when I read Beating the Street by legendary

mutual fund manager Peter Lynch in the mid-1990s. It’s a handy calculation

to see how quickly you can basically double your money.