Page 1136 - How to Make Money in Stocks Trilogy

P. 1136

122 HOW TO MAKE MONEY IN STOCKS—GETTING STARTED

Here’s how it works: Take the gain you have in a stock (or any other

investment), described as a percentage. Then divide 72 by that number. The

answer tells you how many times you have to compound that gain to essen-

tially double your money.

For example, let’s say you nailed down a 24% gain in a stock. 72 divided

by 24 is 3. That means if you reinvested that same money (including your

24% profit) and got two more 24% gains, you’d nearly double your money.

You’ll find it’s easier to get three 20%–25% gains in a few differ-

ent stocks than it is to score a 100% profit in one. As the following

table shows, if you compound those gains, those smaller wins turn into

major profits.

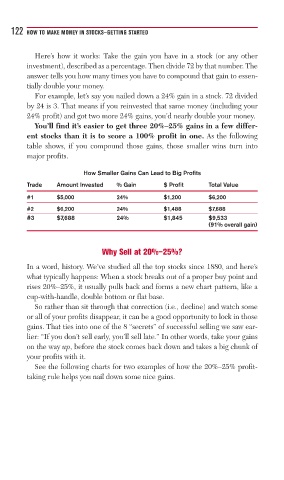

How Smaller Gains Can Lead to Big Profits

Trade Amount Invested % Gain $ Profit Total Value

#1 $5,000 24% $1,200 $6,200

#2 $6,200 24% $1,488 $7,688

#3 $7,688 24% $1,845 $9,533

(91% overall gain)

Why Sell at 20%–25%?

In a word, history. We’ve studied all the top stocks since 1880, and here’s

what typically happens: When a stock breaks out of a proper buy point and

rises 20%–25%, it usually pulls back and forms a new chart pattern, like a

cup-with-handle, double bottom or flat base.

So rather than sit through that correction (i.e., decline) and watch some

or all of your profits disappear, it can be a good opportunity to lock in those

gains. That ties into one of the 8 “secrets” of successful selling we saw ear-

lier: “If you don’t sell early, you’ll sell late.” In other words, take your gains

on the way up, before the stock comes back down and takes a big chunk of

your profits with it.

See the following charts for two examples of how the 20%–25% profit-

taking rule helps you nail down some nice gains.