Page 1188 - How to Make Money in Stocks Trilogy

P. 1188

Don’t Invest Blindly: Use Charts to See the Best Time to Buy and Sell 171

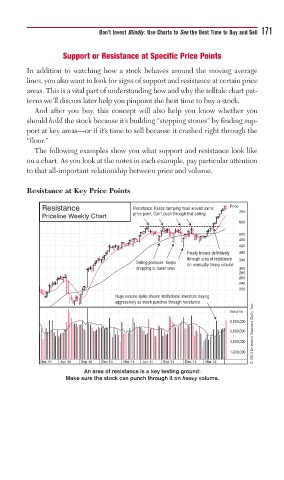

Support or Resistance at Specific Price Points

In addition to watching how a stock behaves around the moving average

lines, you also want to look for signs of support and resistance at certain price

areas. This is a vital part of understanding how and why the telltale chart pat-

terns we’ll discuss later help you pinpoint the best time to buy a stock.

And after you buy, this concept will also help you know whether you

should hold the stock because it’s building “stepping stones” by finding sup-

port at key areas—or if it’s time to sell because it crashed right through the

“floor.”

The following examples show you what support and resistance look like

on a chart. As you look at the notes in each example, pay particular attention

to that all-important relationship between price and volume.

Resistance at Key Price Points

Resistance Resistance: Keeps bumping head around same Price

price point. Can’t push through that ceiling. 700

Priceline Weekly Chart

600

500

460

420

Finally breaks definitively 380

through area of resistance 340

Selling pressure: Keeps on unusually heavy volume

dropping to lower lows 300

280

260

240

220

Huge volume spike shows institutional investors buying

aggressively as stock punches through resistance

© 2013 Investor’s Business Daily, Inc.

Volume

8,000,000

5,000,000

3,000,000

1,800,000

Mar 10 Jun 10 Sep 10 Dec 10 Mar 11 Jun 11 Sep 11 Dec 11 Mar 12

An area of resistance is a key testing ground:

Make sure the stock can punch through it on heavy volume.