Page 1187 - How to Make Money in Stocks Trilogy

P. 1187

170 HOW TO MAKE MONEY IN STOCKS—GETTING STARTED

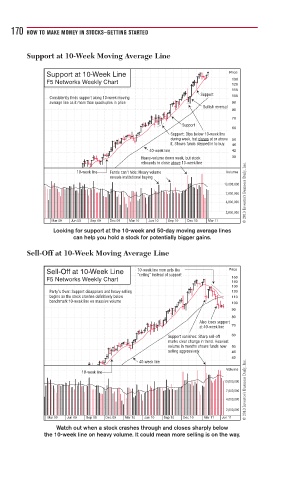

Support at 10-Week Moving Average Line

Support at 10-Week Line Price

130

F5 Networks Weekly Chart 120

110

Support

Consistently finds support along 10-week moving 100

average line as it more than quadruples in price 90

Bullish reversal

80

70

Support

60

Support: Dips below 10-week line

during week, but closes at or above 50

it. Shows funds stepped in to buy. 46

40-week line 42

Heavy-volume down week, but stock 38

rebounds to close above 10-week line

© 2013 Investor’s Business Daily, Inc.

10-week line Funds can’t hide: Heavy volume Volume

reveals institutional buying

13,000,000

7,000,000

4,000,000

2,000,000

Mar 09 Jun 09 Sep 09 Dec 09 Mar 10 Jun 10 Sep 10 Dec 10 Mar 11

Looking for support at the 10-week and 50-day moving average lines

can help you hold a stock for potentially bigger gains.

Sell-Off at 10-Week Moving Average Line

Sell-Off at 10-Week Line 10-week line now acts like Price

“ceiling” instead of support

F5 Networks Weekly Chart 150

140

130

Party’s Over: Support disappears and heavy selling 120

begins as the stock crashes definitively below 110

benchmark 10-week line on massive volume 100

90

80

Also loses support

at 40-week line 70

Support vanishes: Sharp sell-off 60

marks clear change in trend. Heaviest

volume in months shows funds now 50

selling aggressively. 46

42

© 2013 Investor’s Business Daily, Inc.

40-week line

Volume

10-week line

13,000,000

7,000,000

4,000,000

2,000,000

Mar 09 Jun 09 Sep 09 Dec 09 Mar 10 Jun 10 Sep 10 Dec 10 Mar 11 Jun 11

Watch out when a stock crashes through and closes sharply below

the 10-week line on heavy volume. It could mean more selling is on the way.