Page 1183 - How to Make Money in Stocks Trilogy

P. 1183

166 HOW TO MAKE MONEY IN STOCKS—GETTING STARTED

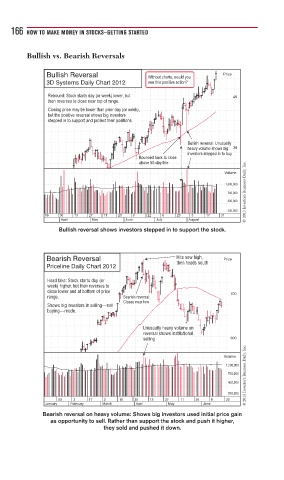

Bullish vs. Bearish Reversals

Bullish Reversal Without charts, would you Price

3D Systems Daily Chart 2012 see this positive action?

Rebound: Stock starts day (or week) lower, but 40

then reverses to close near top of range.

Closing price may be lower than prior day (or week),

but the positive reversal shows big investors

stepped in to support and protect their positions.

Bullish reversal: Unusually

heavy volume shows big 30

investors stepped in to buy

Bounced back to close

above 50-day line

© 2013 Investor’s Business Daily, Inc.

Volume

1,300,000

700,000

400,000

200,000

16 30 13 27 11 25 8 22 6 20 3 17 31

April May June July August

Bullish reversal shows investors stepped in to support the stock.

Bearish Reversal Hits new high, Price

then heads south

Priceline Daily Chart 2012

Head fake: Stock starts day (or

week) higher, but then reverses to

close lower and at bottom of price

range. Bearish reversal: 700

Closes near low

Shows big investors in selling—not

buying—mode.

Unusually heavy volume on

reversal shows institutional

selling 600

© 2013 Investor’s Business Daily, Inc.

Volume

1,200,000

700,000

400,000

200,000

20 3 17 2 16 30 13 27 11 25 8 22

January February March April May June

Bearish reversal on heavy volume: Shows big investors used initial price gain

as opportunity to sell. Rather than support the stock and push it higher,

they sold and pushed it down.