Page 1248 - How to Make Money in Stocks Trilogy

P. 1248

230 HOW TO MAKE MONEY IN STOCKS—GETTING STARTED

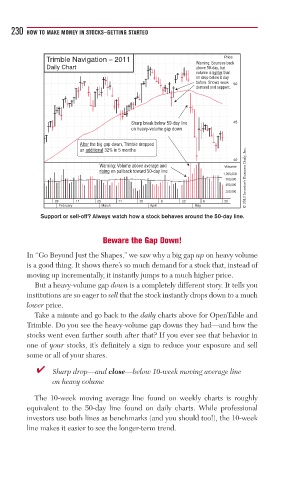

Trimble Navigation – 2011 Price

Warning: Bounces back

Daily Chart above 50-day, but

volume is lighter than

on drop below it day

before. Shows weak

50

demand and support.

Sharp break below 50-day line 45

on heavy-volume gap down

After the big gap down, Trimble dropped

an additional 32% in 5 months

40

Warning: Volume above average and Volume

rising on pullback toward 50-day line

1,200,000

700,000 © 2013 Investor’s Business Daily, Inc.

400,000

200,000

28 11 25 11 25 8 22 6 20

February March April May

Support or sell-off? Always watch how a stock behaves around the 50-day line.

Beware the Gap Down!

In “Go Beyond Just the Shapes,” we saw why a big gap up on heavy volume

is a good thing. It shows there’s so much demand for a stock that, instead of

moving up incrementally, it instantly jumps to a much higher price.

But a heavy-volume gap down is a completely different story. It tells you

institutions are so eager to sell that the stock instantly drops down to a much

lower price.

Take a minute and go back to the daily charts above for OpenTable and

Trimble. Do you see the heavy-volume gap downs they had—and how the

stocks went even farther south after that? If you ever see that behavior in

one of your stocks, it’s definitely a sign to reduce your exposure and sell

some or all of your shares.

■ ✔ Sharp drop—and close—below 10-week moving average line

on heavy volume

The 10-week moving average line found on weekly charts is roughly

equivalent to the 50-day line found on daily charts. While professional

investors use both lines as benchmarks (and you should too!), the 10-week

line makes it easier to see the longer-term trend.