Page 1245 - How to Make Money in Stocks Trilogy

P. 1245

Don’t Invest Blindly: Use Charts to See the Best Time to Buy and Sell 227

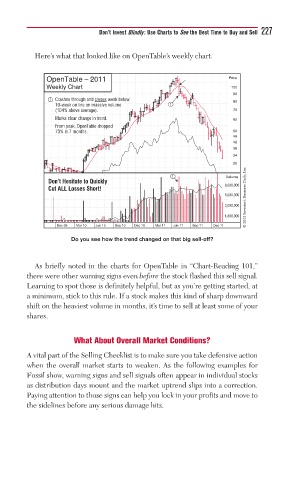

Here’s what that looked like on OpenTable’s weekly chart.

OpenTable – 2011 Price

Weekly Chart 100

90

1 Crashes through and closes week below 80

10-week on line on massive volume 1

(104% above average). 70

Marks clear change in trend. 60

From peak, OpenTable dropped

73% in 7 months. 50

46

42

38

34

30

© 2013 Investor’s Business Daily, Inc.

1 Volume

Don’t Hesitate to Quickly

8,000,000

Cut ALL Losses Short!

5,000,000

3,000,000

1,800,000

Dec 09 Mar 10 Jun 10 Sep 10 Dec 10 Mar 11 Jun 11 Sep 11 Dec 11

Do you see how the trend changed on that big sell-off?

As briefly noted in the charts for OpenTable in “Chart-Reading 101,”

there were other warning signs even before the stock flashed this sell signal.

Learning to spot those is definitely helpful, but as you’re getting started, at

a minimum, stick to this rule. If a stock makes this kind of sharp downward

shift on the heaviest volume in months, it’s time to sell at least some of your

shares.

What About Overall Market Conditions?

A vital part of the Selling Checklist is to make sure you take defensive action

when the overall market starts to weaken. As the following examples for

Fossil show, warning signs and sell signals often appear in individual stocks

as distribution days mount and the market uptrend slips into a correction.

Paying attention to those signs can help you lock in your profits and move to

the sidelines before any serious damage hits.