Page 1249 - How to Make Money in Stocks Trilogy

P. 1249

Don’t Invest Blindly: Use Charts to See the Best Time to Buy and Sell 231

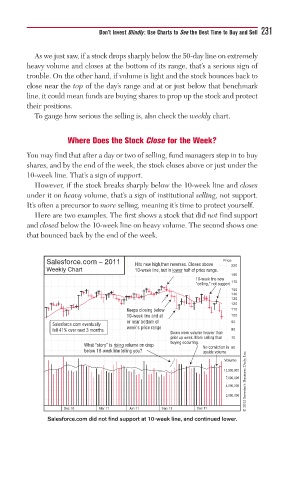

As we just saw, if a stock drops sharply below the 50-day line on extremely

heavy volume and closes at the bottom of its range, that’s a serious sign of

trouble. On the other hand, if volume is light and the stock bounces back to

close near the top of the day’s range and at or just below that benchmark

line, it could mean funds are buying shares to prop up the stock and protect

their positions.

To gauge how serious the selling is, also check the weekly chart.

Where Does the Stock Close for the Week?

You may find that after a day or two of selling, fund managers step in to buy

shares, and by the end of the week, the stock closes above or just under the

10-week line. That’s a sign of support.

However, if the stock breaks sharply below the 10-week line and closes

under it on heavy volume, that’s a sign of institutional selling, not support.

It’s often a precursor to more selling, meaning it’s time to protect yourself.

Here are two examples. The first shows a stock that did not find support

and closed below the 10-week line on heavy volume. The second shows one

that bounced back by the end of the week.

Salesforce.com – 2011 Price

Hits new high,then reverses. Closes above 220

Weekly Chart 10-week line, but in lower half of price range.

190

10-week line now

“ceiling,” not support 170

150

140

130

120

Keeps closing below 110

10-week line and at 100

or near bottom of 90

Salesforce.com eventually week’s price range

fell 41% over next 3 months 80

Down week volume heavier than

prior up week. More selling than 70

buying occurring.

What “story” is rising volume on drop No conviction in 60

below 10-week line telling you? upside volume

© 2013 Investor’s Business Daily, Inc.

Volume

12,000,000

7,000,000

4,000,000

2,000,000

Dec 10 Mar 11 Jun 11 Sep 11 Dec 11

Salesforce.com did not find support at 10-week line, and continued lower.