Page 172 - How to Make Money in Stocks Trilogy

P. 172

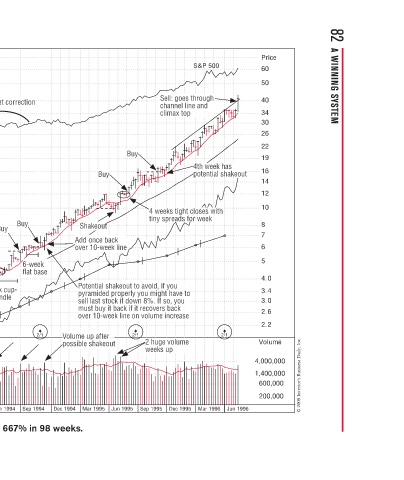

82 A WINNING SYSTEM

Price 60 50 40 34 30 26 22 19 16 14 12 10 8 7 6 5 4.0 3.4 3.0 2.6 2.2 Volume 4,000,000 1,400,000 600,000 200,000 Jun 1996 © 2009 Investor’s Business Daily, Inc.

S&P 500 h u d h week has h e w 4 h w w 4th w potential shakeout t t potential shakeout k k h h l tti e h ih oses with h w closes w closes w e or week e 2/1 Mar 1996

Sell: goes through Sell: goes through h e g e channel line and n h climax top climax top o ax po p p p 4 weeks tight clos lo h h i t k k or w tiny spreads for s a p p yp u y o o t a t you y If so o c s r n 2 huge volume e m p u u Dec 1995

Buy kline Potential shakeout to avoid, if you u e o sell last stock if down 8%. If so, you ck if down 8% d must buy it back if it recovers back k a over 10-week line on volume increase e Jun 1995

y 4 w n d v o pyramided properly you might have to properly you might have to u y 8 v c t m o n 2/1 u 2 weeks up e w Sep 1995

Buy y B ut out out k a over 10-week line e k h sell last stock o t y e r t o

Shakeout t t t Shakeout a S Add once back c o Add Add d d over 10-week - v i e P pyramided p i a p s s b s m 0 r o Volume up after Volume up after a u m o possible shakeout a s b o Mar 1995

week k 6-week 6-wee flat base fl 2/1 Dec 1994 Sep 1994

Market correction Market correction e B Buy B 18-week cup- week cup with-handle Jun 1994

n

n

Buy

Buy

a

4 weeks tight closes 4 weeks tight closes gh Dec 1993

ht closes s w 18 - Mar 1994 Gartner Group increased 667% in 98 weeks.

IPO IPO * *

Sep 1993

Jun 1993

Mar 1993

Dec 1992 Sep 1992

Gartner Group–1994 Weekly Chart Jun 1992 Mar 1992

Price = 20*eps 3.00 2.50 2.25 2.00 1.80 1.60 1.50 1.40 1.30 1.20 1.10 1.00 0.90 0.80 0.75 0.70 0.65 0.60 0.55 0.50 0.45 0.40 0.35 0.30 0.25 0.23 0.20 0.18 0.16 0.15 0.14 0.13 0.12 0.11