Page 271 - How to Make Money in Stocks Trilogy

P. 271

How to Read Charts Like a Pro and Improve Your Selection and Timing 149

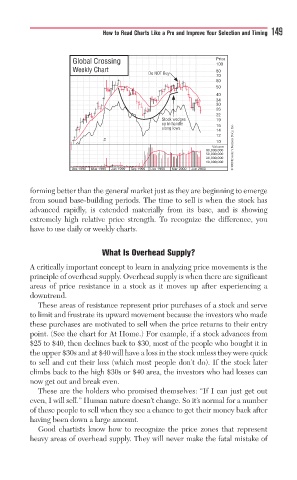

Global Crossing Price

100

Weekly Chart 80

D D Do NOT BuyNOT BNOT y 70

60

50

40

34

30

26

22

Stock 19

Stock wedges wedgesek we

S

u

up in handle en han 16

along lowsl a g g l g low

14

12

10

2/1

Volume © 2009 Investor’s Business Daily, Inc.

80,000,000

50,000,000

30,000,000

18,000,000

Dec 1998 Mar 1999 Jun 1999 Sep 1999 Dec 1999 Mar 2000 Jun 2000

forming better than the general market just as they are beginning to emerge

from sound base-building periods. The time to sell is when the stock has

advanced rapidly, is extended materially from its base, and is showing

extremely high relative price strength. To recognize the difference, you

have to use daily or weekly charts.

What Is Overhead Supply?

A critically important concept to learn in analyzing price movements is the

principle of overhead supply. Overhead supply is when there are significant

areas of price resistance in a stock as it moves up after experiencing a

downtrend.

These areas of resistance represent prior purchases of a stock and serve

to limit and frustrate its upward movement because the investors who made

these purchases are motivated to sell when the price returns to their entry

point. (See the chart for At Home.) For example, if a stock advances from

$25 to $40, then declines back to $30, most of the people who bought it in

the upper $30s and at $40 will have a loss in the stock unless they were quick

to sell and cut their loss (which most people don’t do). If the stock later

climbs back to the high $30s or $40 area, the investors who had losses can

now get out and break even.

These are the holders who promised themselves: “If I can just get out

even, I will sell.” Human nature doesn’t change. So it’s normal for a number

of these people to sell when they see a chance to get their money back after

having been down a large amount.

Good chartists know how to recognize the price zones that represent

heavy areas of overhead supply. They will never make the fatal mistake of