Page 272 - How to Make Money in Stocks Trilogy

P. 272

150 A WINNING SYSTEM

At Home Price

120

Weekly Chart 100

Ovev rheaddhead d d d 80

pp

supplyu pp yyyy 70

60

50

40

34

30

26

22

19

16

14

2/1 12

Volume

30,000,000 © 2009 Investor’s Business Daily, Inc.

16,000,000

8,000,000

4,000,000

2,000,000

Sep 1998 Dec 1998 Mar 1999 Jun 1999 Sep 1999 Dec 1999 Mar 2000

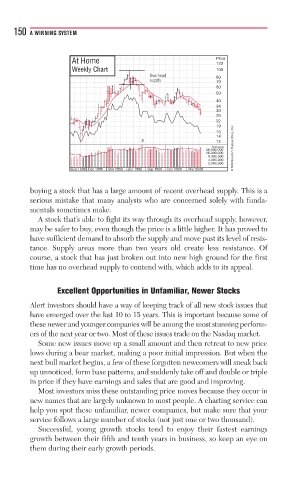

buying a stock that has a large amount of recent overhead supply. This is a

serious mistake that many analysts who are concerned solely with funda-

mentals sometimes make.

A stock that’s able to fight its way through its overhead supply, however,

may be safer to buy, even though the price is a little higher. It has proved to

have sufficient demand to absorb the supply and move past its level of resis-

tance. Supply areas more than two years old create less resistance. Of

course, a stock that has just broken out into new high ground for the first

time has no overhead supply to contend with, which adds to its appeal.

Excellent Opportunities in Unfamiliar, Newer Stocks

Alert investors should have a way of keeping track of all new stock issues that

have emerged over the last 10 to 15 years. This is important because some of

these newer and younger companies will be among the most stunning perform-

ers of the next year or two. Most of these issues trade on the Nasdaq market.

Some new issues move up a small amount and then retreat to new price

lows during a bear market, making a poor initial impression. But when the

next bull market begins, a few of these forgotten newcomers will sneak back

up unnoticed, form base patterns, and suddenly take off and double or triple

in price if they have earnings and sales that are good and improving.

Most investors miss these outstanding price moves because they occur in

new names that are largely unknown to most people. A charting service can

help you spot these unfamiliar, newer companies, but make sure that your

service follows a large number of stocks (not just one or two thousand).

Successful, young growth stocks tend to enjoy their fastest earnings

growth between their fifth and tenth years in business, so keep an eye on

them during their early growth periods.