Page 337 - How to Make Money in Stocks Trilogy

P. 337

M = Market Direction: How You Can Determine It 213

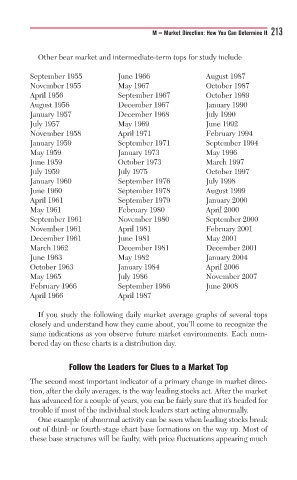

Other bear market and intermediate-term tops for study include

September 1955 June 1966 August 1987

November 1955 May 1967 October 1987

April 1956 September 1967 October 1989

August 1956 December 1967 January 1990

January 1957 December 1968 July 1990

July 1957 May 1969 June 1992

November 1958 April 1971 February 1994

January 1959 September 1971 September 1994

May 1959 January 1973 May 1996

June 1959 October 1973 March 1997

July 1959 July 1975 October 1997

January 1960 September 1976 July 1998

June 1960 September 1978 August 1999

April 1961 September 1979 January 2000

May 1961 February 1980 April 2000

September 1961 November 1980 September 2000

November 1961 April 1981 February 2001

December 1961 June 1981 May 2001

March 1962 December 1981 December 2001

June 1963 May 1982 January 2004

October 1963 January 1984 April 2006

May 1965 July 1986 November 2007

February 1966 September 1986 June 2008

April 1966 April 1987

If you study the following daily market average graphs of several tops

closely and understand how they came about, you’ll come to recognize the

same indications as you observe future market environments. Each num-

bered day on these charts is a distribution day.

Follow the Leaders for Clues to a Market Top

The second most important indicator of a primary change in market direc-

tion, after the daily averages, is the way leading stocks act. After the market

has advanced for a couple of years, you can be fairly sure that it’s headed for

trouble if most of the individual stock leaders start acting abnormally.

One example of abnormal activity can be seen when leading stocks break

out of third- or fourth-stage chart base formations on the way up. Most of

these base structures will be faulty, with price fluctuations appearing much