Page 341 - How to Make Money in Stocks Trilogy

P. 341

M = Market Direction: How You Can Determine It 217

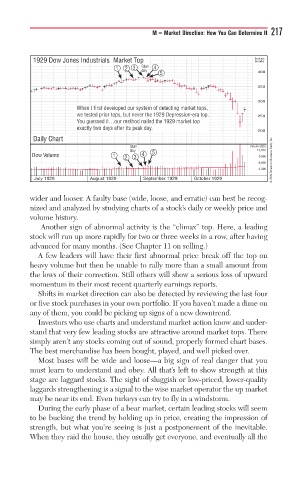

1929 Dow Jones Industrials Market Top Index

Scale

Stall

1 2 3 Stall y 4

day

d

day

5 400

350

300

W y g k et tops,

When

et tops,o

When I first developed our system of detecting markpI first developed our system of detecting markaetectinmslt

we

we tested prior tops, but never the 1929 Depression-tested prior tops, but never the 1929 Depressione tested p io tops b t ne e the 1929 Dep esssiono9 Depe 1929vuors

w -era top.era top.e a topa . . 250

-

Y Y Y You guessed it…our method nailed the 1929 market ou guessed itou guessed itdu our kk topp

top

our method nmethod nailed the 1929 market19299ed the dm

Y Y Y Y Y

exactly two days ay two ddays ay y f fter its peak dapter its peak daai y y y y.

e

exactly

200

Daily Chart

Stall Volume (00)

day

day y 13,200

Dow Volume 1 2 3 4 5 9,900

6,600 © 2009 Investor’s Business Daily, Inc.

3,300

July 1929 August 1929 September 1929 October 1929

wider and looser. A faulty base (wide, loose, and erratic) can best be recog-

nized and analyzed by studying charts of a stock’s daily or weekly price and

volume history.

Another sign of abnormal activity is the “climax” top. Here, a leading

stock will run up more rapidly for two or three weeks in a row, after having

advanced for many months. (See Chapter 11 on selling.)

A few leaders will have their first abnormal price break off the top on

heavy volume but then be unable to rally more than a small amount from

the lows of their correction. Still others will show a serious loss of upward

momentum in their most recent quarterly earnings reports.

Shifts in market direction can also be detected by reviewing the last four

or five stock purchases in your own portfolio. If you haven’t made a dime on

any of them, you could be picking up signs of a new downtrend.

Investors who use charts and understand market action know and under-

stand that very few leading stocks are attractive around market tops. There

simply aren’t any stocks coming out of sound, properly formed chart bases.

The best merchandise has been bought, played, and well picked over.

Most bases will be wide and loose—a big sign of real danger that you

must learn to understand and obey. All that’s left to show strength at this

stage are laggard stocks. The sight of sluggish or low-priced, lower-quality

laggards strengthening is a signal to the wise market operator the up market

may be near its end. Even turkeys can try to fly in a windstorm.

During the early phase of a bear market, certain leading stocks will seem

to be bucking the trend by holding up in price, creating the impression of

strength, but what you’re seeing is just a postponement of the inevitable.

When they raid the house, they usually get everyone, and eventually all the