Page 133 - Account 10

P. 133

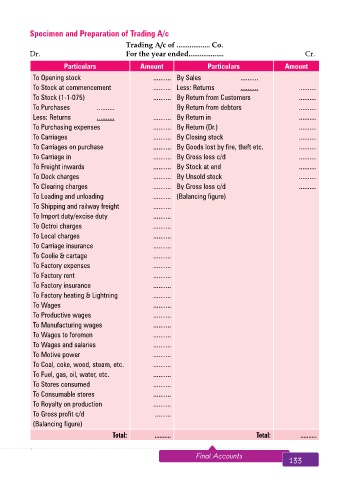

Specimen and Preparation of Trading A/c

Trading A/c of .................. Co.

Dr. For the year ended................... Cr.

Particulars Amount Particulars Amount

To Opening stock .......... By Sales ..........

To Stock at commencement .......... Less: Returns .......... ..........

To Stock (1-1-075) .......... By Return from Customers ..........

To Purchases .......... By Return from debtors ..........

Less: Returns .......... .......... By Return in ..........

To Purchasing expenses .......... By Return (Dr.) ..........

To Carriages .......... By Closing stock ..........

To Carriages on purchase .......... By Goods lost by fire, theft etc. ..........

To Carriage in .......... By Gross loss c/d ..........

To Freight inwards .......... By Stock at end ..........

To Dock charges .......... By Unsold stock ..........

To Clearing charges .......... By Gross loss c/d ..........

To Loading and unloading .......... (Balancing figure)

To Shipping and railway freight ..........

To Import duty/excise duty ..........

To Octroi charges ..........

To Local charges ..........

To Carriage insurance ..........

To Coolie & cartage ..........

To Factory expenses ..........

To Factory rent ..........

To Factory insurance ..........

To Factory heating & Lightning ..........

To Wages ..........

To Productive wages ..........

To Manufacturing wages ..........

To Wages to foremen ..........

To Wages and salaries ..........

To Motive power ..........

To Coal, coke, wood, steam, etc. ..........

To Fuel, gas, oil, water, etc. ..........

To Stores consumed ..........

To Consumable stores ..........

To Royalty on production ..........

To Gross profit c/d .........

(Balancing figure)

Total: .......... Total: ..........

132 Aakar’s Office Practice and Accountancy - 10 Final Accounts 133