Page 136 - Account 10

P. 136

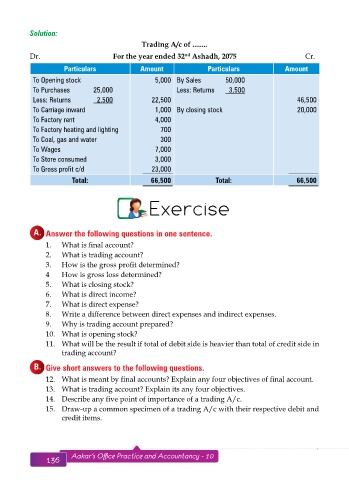

Solution:

Trading A/c of ........

Dr. For the year ended 32 Ashadh, 2075 Cr.

nd

Particulars Amount Particulars Amount

To Opening stock 5,000 By Sales 50,000

To Purchases 25,000 Less: Returns 3,500

Less: Returns 2,500 22,500 46,500

To Carriage inward 1,000 By closing stock 20,000

To Factory rent 4,000

To Factory heating and lighting 700

To Coal, gas and water 300

To Wages 7,000

To Store consumed 3,000

To Gross profit c/d 23,000

Total: 66,500 Total: 66,500

Exercise

A. Answer the following questions in one sentence.

1. What is final account?

2. What is trading account?

3. How is the gross profit determined?

4 How is gross loss determined?

5. What is closing stock?

6. What is direct income?

7. What is direct expense?

8. Write a difference between direct expenses and indirect expenses.

9. Why is trading account prepared?

10. What is opening stock?

11. What will be the result if total of debit side is heavier than total of credit side in

trading account?

B. Give short answers to the following questions.

12. What is meant by final accounts? Explain any four objectives of final account.

13. What is trading account? Explain its any four objectives.

14. Describe any five point of importance of a trading A/c.

15. Draw-up a common specimen of a trading A/c with their respective debit and

credit items.

136 Aakar’s Office Practice and Accountancy - 10 Final Accounts 137