Page 134 - Account 10

P. 134

Procedures of Preparing Trading Account

There are the procedures which are followed while preparing trading account.

1. A proper format should be drawn and name of company and the date should be

maintained at the top.

2. It is prepared in the form of ledger account and thus, it contains two sides; debit

and credit.

3. It is treated as nominal account and all the losses and expenses are debited and

all gains and incomes are credited.

4. The word ‘To’ is used in debit side and ‘By’ in credit side.

5. Opening stock and direct expenses are entered in debit side sales and closing

stock are entered in credit side.

6. The gross profit or gross loss should be determined by comparing the debit total

and credit total.

7. The balancing figure appearing in debit side is termed as gross profit under the

word “To gross profit c/d” and the balancing figure appearing in credit side is

termed as gross loss under the word “By gross loss c/d”.

8. After the determination of gross profit and gross loss, it should be closed by

drawing two parallel lines.

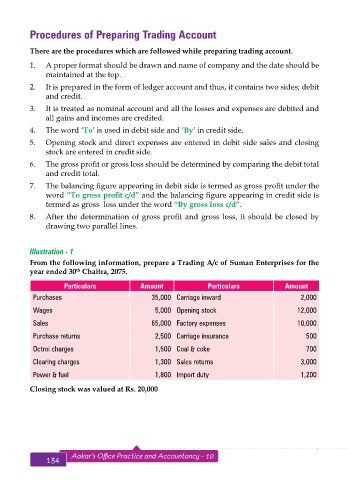

Illustration - 1

From the following information, prepare a Trading A/c of Suman Enterprises for the

year ended 30 Chaitra, 2075.

th

Particulars Amount Particulars Amount

Purchases 35,000 Carriage inward 2,000

Wages 5,000 Opening stock 12,000

Sales 65,000 Factory expenses 10,000

Purchase returns 2,500 Carriage insurance 500

Octroi charges 1,500 Coal & coke 700

Clearing charges 1,300 Sales returns 3,000

Power & fuel 1,800 Import duty 1,200

Closing stock was valued at Rs. 20,000

134 Aakar’s Office Practice and Accountancy - 10 Final Accounts 135