Page 162 - Account 10

P. 162

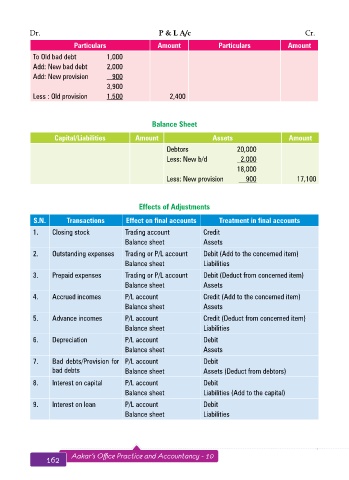

Dr. P & L A/c Cr.

Particulars Amount Particulars Amount

To Old bad debt 1,000

Add: New bad debt 2,000

Add: New provision 900

3,900

Less : Old provision 1.500 2,400

Balance Sheet

Capital/Liabilities Amount Assets Amount

Debtors 20,000

Less: New b/d 2.000

18,000

Less: New provision 900 17,100

Effects of Adjustments

S.N. Transactions Effect on final accounts Treatment in final accounts

1. Closing stock Trading account Credit

Balance sheet Assets

2. Outstanding expenses Trading or P/L account Debit (Add to the concerned item)

Balance sheet Liabilities

3. Prepaid expenses Trading or P/L account Debit (Deduct from concerned item)

Balance sheet Assets

4. Accrued incomes P/L account Credit (Add to the concerned item)

Balance sheet Assets

5. Advance incomes P/L account Credit (Deduct from concerned item)

Balance sheet Liabilities

6. Depreciation P/L account Debit

Balance sheet Assets

7. Bad debts/Provision for P/L account Debit

bad debts Balance sheet Assets (Deduct from debtors)

8. Interest on capital P/L account Debit

Balance sheet Liabilities (Add to the capital)

9. Interest on loan P/L account Debit

Balance sheet Liabilities

162 Aakar’s Office Practice and Accountancy - 10 Final Accounts 163