Page 158 - Account 10

P. 158

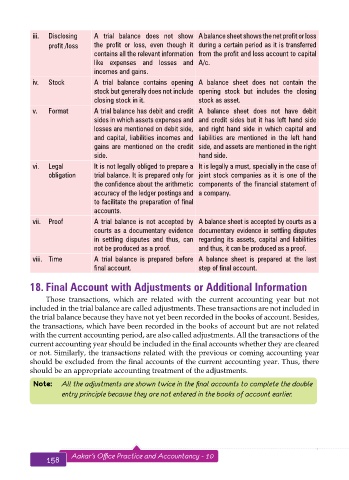

iii. Disclosing A trial balance does not show A balance sheet shows the net profit or loss

profit /loss the profit or loss, even though it during a certain period as it is transferred

contains all the relevant information from the profit and loss account to capital

like expenses and losses and A/c.

incomes and gains.

iv. Stock A trial balance contains opening A balance sheet does not contain the

stock but generally does not include opening stock but includes the closing

closing stock in it. stock as asset.

v. Format A trial balance has debit and credit A balance sheet does not have debit

sides in which assets expenses and and credit sides but it has left hand side

losses are mentioned on debit side, and right hand side in which capital and

and capital, liabilities incomes and liabilities are mentioned in the left hand

gains are mentioned on the credit side, and assets are mentioned in the right

side. hand side.

vi. Legal It is not legally obliged to prepare a It is legally a must, specially in the case of

obligation trial balance. It is prepared only for joint stock companies as it is one of the

the confidence about the arithmetic components of the financial statement of

accuracy of the ledger postings and a company.

to facilitate the preparation of final

accounts.

vii. Proof A trial balance is not accepted by A balance sheet is accepted by courts as a

courts as a documentary evidence documentary evidence in settling disputes

in settling disputes and thus, can regarding its assets, capital and liabilities

not be produced as a proof. and thus, it can be produced as a proof.

viii. Time A trial balance is prepared before A balance sheet is prepared at the last

final account. step of final account.

18. Final Account with Adjustments or Additional Information

Those transactions, which are related with the current accounting year but not

included in the trial balance are called adjustments. These transactions are not included in

the trial balance because they have not yet been recorded in the books of account. Besides,

the transactions, which have been recorded in the books of account but are not related

with the current accounting period, are also called adjustments. All the transactions of the

current accounting year should be included in the final accounts whether they are cleared

or not. Similarly, the transactions related with the previous or coming accounting year

should be excluded from the final accounts of the current accounting year. Thus, there

should be an appropriate accounting treatment of the adjustments.

Note: All the adjustments are shown twice in the final accounts to complete the double

entry principle because they are not entered in the books of account earlier.

158 Aakar’s Office Practice and Accountancy - 10 Final Accounts 159