Page 173 - Account 10

P. 173

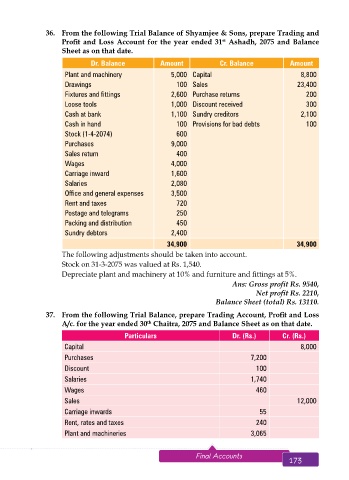

36. From the following Trial Balance of Shyamjee & Sons, prepare Trading and

Profit and Loss Account for the year ended 31 Ashadh, 2075 and Balance

st

Sheet as on that date.

Dr. Balance Amount Cr. Balance Amount

Plant and machinery 5,000 Capital 8,800

Drawings 100 Sales 23,400

Fixtures and fittings 2,600 Purchase returns 200

Loose tools 1,000 Discount received 300

Cash at bank 1,100 Sundry creditors 2,100

Cash in hand 100 Provisions for bad debts 100

Stock (1-4-2074) 600

Purchases 9,000

Sales return 400

Wages 4,000

Carriage inward 1,600

Salaries 2,080

Office and general expenses 3,500

Rent and taxes 720

Postage and telegrams 250

Packing and distribution 450

Sundry debtors 2,400

34,900 34,900

The following adjustments should be taken into account.

Stock on 31-3-2075 was valued at Rs. 1,540.

Depreciate plant and machinery at 10% and furniture and fittings at 5%.

Ans: Gross profit Rs. 9540,

Net profit Rs. 2210,

Balance Sheet (total) Rs. 13110.

37. From the following Trial Balance, prepare Trading Account, Profit and Loss

A/c. for the year ended 30 Chaitra, 2075 and Balance Sheet as on that date.

th

Particulars Dr. (Rs.) Cr. (Rs.)

Capital 8,000

Purchases 7,200

Discount 100

Salaries 1,740

Wages 460

Sales 12,000

Carriage inwards 55

Rent, rates and taxes 240

Plant and machineries 3,065

172 Aakar’s Office Practice and Accountancy - 10 Final Accounts 173