Page 174 - Account 10

P. 174

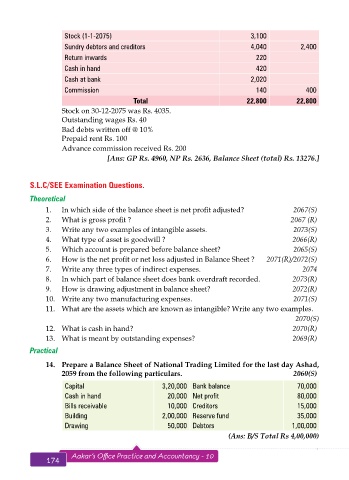

Stock (1-1-2075) 3,100

Sundry debtors and creditors 4,040 2,400

Return inwards 220

Cash in hand 420

Cash at bank 2,020

Commission 140 400

Total 22,800 22,800

Stock on 30-12-2075 was Rs. 4035.

Outstanding wages Rs. 40

Bad debts written off @ 10%

Prepaid rent Rs. 100

Advance commission received Rs. 200

[Ans: GP Rs. 4960, NP Rs. 2636, Balance Sheet (total) Rs. 13276.]

S.L.C/SEE Examination Questions.

Theoretical

1. In which side of the balance sheet is net profit adjusted? 2067(S)

2. What is gross profit ? 2067 (R)

3. Write any two examples of intangible assets. 2073(S)

4. What type of asset is goodwill ? 2066(R)

5. Which account is prepared before balance sheet? 2065(S)

6. How is the net profit or net loss adjusted in Balance Sheet ? 2071(R)/2072(S)

7. Write any three types of indirect expenses. 2074

8. In which part of balance sheet does bank overdraft recorded. 2073(R)

9. How is drawing adjustment in balance sheet? 2072(R)

10. Write any two manufacturing expenses. 2071(S)

11. What are the assets which are known as intangible? Write any two examples.

2070(S)

12. What is cash in hand? 2070(R)

13. What is meant by outstanding expenses? 2069(R)

Practical

14. Prepare a Balance Sheet of National Trading Limited for the last day Ashad,

2059 from the following particulars. 2060(S)

Capital 3,20,000 Bank balance 70,000

Cash in hand 20,000 Net profit 80,000

Bills receivable 10,000 Creditors 15,000

Building 2,00,000 Reserve fund 35,000

Drawing 50,000 Debtors 1,00,000

(Ans: B/S Total Rs 4,00,000)

174 Aakar’s Office Practice and Accountancy - 10 Final Accounts 175