Page 175 - Account 10

P. 175

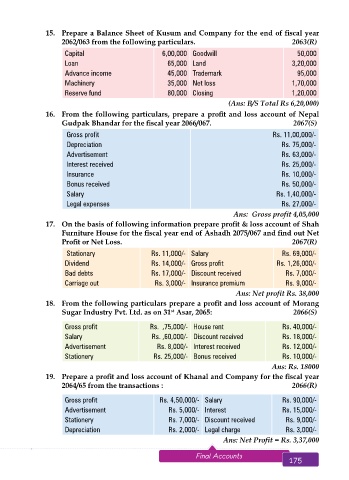

15. Prepare a Balance Sheet of Kusum and Company for the end of fiscal year

2062/063 from the following particulars. 2063(R)

Capital 6,00,000 Goodwill 50,000

Loan 65,000 Land 3,20,000

Advance income 45,000 Trademark 95,000

Machinery 35,000 Net loss 1,70,000

Reserve fund 80,000 Closing 1,20,000

(Ans: B/S Total Rs 6,20,000)

16. From the following particulars, prepare a profit and loss account of Nepal

Gudpak Bhandar for the fiscal year 2066/067. 2067(S)

Gross profit Rs. 11,00,000/-

Depreciation Rs. 75,000/-

Advertisement Rs. 63,000/-

Interest received Rs. 25,000/-

Insurance Rs. 10,000/-

Bonus received Rs. 50,000/-

Salary Rs. 1,40,000/-

Legal expenses Rs. 27,000/-

Ans: Gross profit 4,05,000

17. On the basis of following information prepare profit & loss account of Shah

Furniture House for the fiscal year end of Ashadh 2075/067 and find out Net

Profit or Net Loss. 2067(R)

Stationary Rs. 11,000/- Salary Rs. 69,000/-

Dividend Rs. 14,000/- Gross profit Rs. 1,26,000/-

Bad debts Rs. 17,000/- Discount received Rs. 7,000/-

Carriage out Rs. 3,000/- Insurance premium Rs. 9,000/-

Ans: Net profit Rs. 38,000

18. From the following particulars prepare a profit and loss account of Morang

Sugar Industry Pvt. Ltd. as on 31 Asar, 2065: 2066(S)

st

Gross profit Rs. ,75,000/- House rent Rs. 40,000/-

Salary Rs. ,60,000/- Discount received Rs. 18,000/-

Advertisement Rs. 8,000/- Interest received Rs. 12,000/-

Stationery Rs. 25,000/- Bonus received Rs. 10,000/-

Ans: Rs. 18000

19. Prepare a profit and loss account of Khanal and Company for the fiscal year

2064/65 from the transactions : 2066(R)

Gross profit Rs. 4,50,000/- Salary Rs. 90,000/-

Advertisement Rs. 5,000/- Interest Rs. 15,000/-

Stationery Rs. 7,000/- Discount received Rs. 9,000/-

Depreciation Rs. 2,000/- Legal charge Rs. 3,000/-

Ans: Net Profit = Rs. 3,37,000

174 Aakar’s Office Practice and Accountancy - 10 Final Accounts 175