Page 228 - Account 10

P. 228

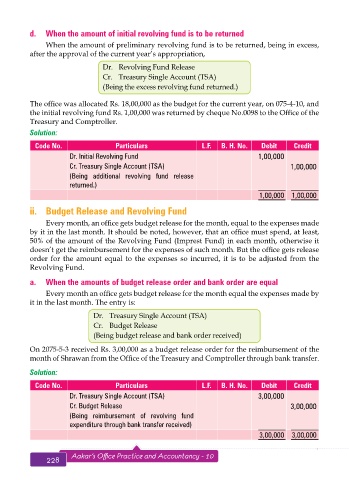

d. When the amount of initial revolving fund is to be returned

When the amount of preliminary revolving fund is to be returned, being in excess,

after the approval of the current year’s appropriation,

Dr. Revolving Fund Release

Cr. Treasury Single Account (TSA)

(Being the excess revolving fund returned.)

The office was allocated Rs. 18,00,000 as the budget for the current year, on 075-4-10, and

the initial revolving fund Rs. 1,00,000 was returned by cheque No.0098 to the Office of the

Treasury and Comptroller.

Solution:

Code No. Particulars L.F. B. H. No. Debit Credit

Dr. Initial Revolving Fund 1,00,000

Cr. Treasury Single Account (TSA) 1,00,000

(Being additional revolving fund release

returned.)

1,00,000 1,00,000

ii. Budget Release and Revolving Fund

Every month, an office gets budget release for the month, equal to the expenses made

by it in the last month. It should be noted, however, that an office must spend, at least,

50% of the amount of the Revolving Fund (Imprest Fund) in each month, otherwise it

doesn’t get the reimbursement for the expenses of such month. But the office gets release

order for the amount equal to the expenses so incurred, it is to be adjusted from the

Revolving Fund.

a. When the amounts of budget release order and bank order are equal

Every month an office gets budget release for the month equal the expenses made by

it in the last month. The entry is:

Dr. Treasury Single Account (TSA)

Cr. Budget Release

(Being budget release and bank order received)

On 2075-5-3 received Rs. 3,00,000 as a budget release order for the reimbursement of the

month of Shrawan from the Office of the Treasury and Comptroller through bank transfer.

Solution:

Code No. Particulars L.F. B. H. No. Debit Credit

Dr. Treasury Single Account (TSA) 3,00,000

Cr. Budget Release 3,00,000

(Being reimbursement of revolving fund

expenditure through bank transfer received)

3,00,000 3,00,000

228 Aakar’s Office Practice and Accountancy - 10 Journal Voucher 229