Page 234 - Account 10

P. 234

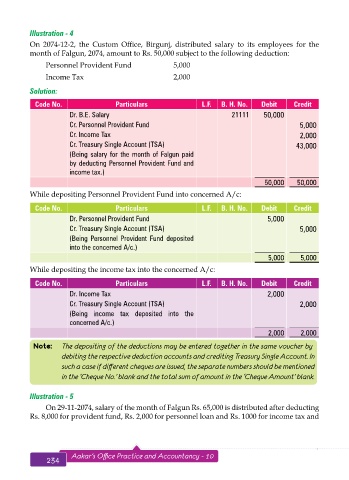

Illustration - 4

On 2074-12-2, the Custom Office, Birgunj, distributed salary to its employees for the

month of Falgun, 2074, amount to Rs. 50,000 subject to the following deduction:

Personnel Provident Fund 5,000

Income Tax 2,000

Solution:

Code No. Particulars L.F. B. H. No. Debit Credit

Dr. B.E. Salary 21111 50,000

Cr. Personnel Provident Fund 5,000

Cr. Income Tax 2,000

Cr. Treasury Single Account (TSA) 43,000

(Being salary for the month of Falgun paid

by deducting Personnel Provident Fund and

income tax.)

50,000 50,000

While depositing Personnel Provident Fund into concerned A/c:

Code No. Particulars L.F. B. H. No. Debit Credit

Dr. Personnel Provident Fund 5,000

Cr. Treasury Single Account (TSA) 5,000

(Being Personnel Provident Fund deposited

into the concerned A/c.)

5,000 5,000

While depositing the income tax into the concerned A/c:

Code No. Particulars L.F. B. H. No. Debit Credit

Dr. Income Tax 2,000

Cr. Treasury Single Account (TSA) 2,000

(Being income tax deposited into the

concerned A/c.)

2,000 2,000

Note: The depositing of the deductions may be entered together in the same voucher by

debiting the respective deduction accounts and crediting Treasury Single Account. In

such a case if different cheques are issued, the separate numbers should be mentioned

in the ‘Cheque No.’ blank and the total sum of amount in the ‘Cheque Amount’ blank.

Illustration - 5

On 29-11-2074, salary of the month of Falgun Rs. 65,000 is distributed after deducting

Rs. 8,000 for provident fund, Rs. 2,000 for personnel loan and Rs. 1000 for income tax and

234 Aakar’s Office Practice and Accountancy - 10 Journal Voucher 235