Page 236 - Account 10

P. 236

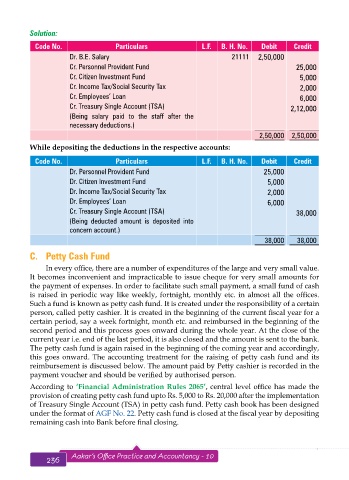

Solution:

Code No. Particulars L.F. B. H. No. Debit Credit

Dr. B.E. Salary 21111 2,50,000

Cr. Personnel Provident Fund 25,000

Cr. Citizen Investment Fund 5,000

Cr. Income Tax/Social Security Tax 2,000

Cr. Employees’ Loan 6,000

Cr. Treasury Single Account (TSA) 2,12,000

(Being salary paid to the staff after the

necessary deductions.)

2,50,000 2,50,000

While depositing the deductions in the respective accounts:

Code No. Particulars L.F. B. H. No. Debit Credit

Dr. Personnel Provident Fund 25,000

Dr. Citizen Investment Fund 5,000

Dr. Income Tax/Social Security Tax 2,000

Dr. Employees’ Loan 6,000

Cr. Treasury Single Account (TSA) 38,000

(Being deducted amount is deposited into

concern account.)

38,000 38,000

C. Petty Cash Fund

In every office, there are a number of expenditures of the large and very small value.

It becomes inconvenient and impracticable to issue cheque for very small amounts for

the payment of expenses. In order to facilitate such small payment, a small fund of cash

is raised in periodic way like weekly, fortnight, monthly etc. in almost all the offices.

Such a fund is known as petty cash fund. It is created under the responsibility of a certain

person, called petty cashier. It is created in the beginning of the current fiscal year for a

certain period, say a week fortnight, month etc. and reimbursed in the beginning of the

second period and this process goes onward during the whole year. At the close of the

current year i.e. end of the last period, it is also closed and the amount is sent to the bank.

The petty cash fund is again raised in the beginning of the coming year and accordingly,

this goes onward. The accounting treatment for the raising of petty cash fund and its

reimbursement is discussed below. The amount paid by Petty cashier is recorded in the

payment voucher and should be verified by authorised person.

According to ‘Financial Administration Rules 2065’, central level office has made the

provision of creating petty cash fund upto Rs. 5,000 to Rs. 20,000 after the implementation

of Treasury Single Account (TSA) in petty cash fund. Petty cash book has been designed

under the format of AGF No. 22. Petty cash fund is closed at the fiscal year by depositing

remaining cash into Bank before final closing.

236 Aakar’s Office Practice and Accountancy - 10 Journal Voucher 237