Page 213 - Office Practice and Accounting 10

P. 213

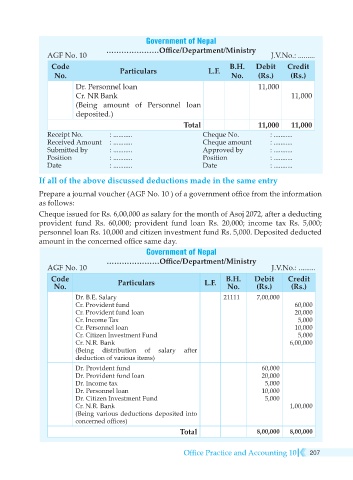

Government of Nepal

…………………Office/Department/Ministry

AGF No. 10 J.V.No.: .........

Code Particulars L.F. B.H. Debit Credit

No. No. (Rs.) (Rs.)

Dr. Personnel loan 11,000

Cr. NR Bank 11,000

(Being amount of Personnel loan

deposited.)

Total 11,000 11,000

Receipt No. : ........... Cheque No. : ...........

Received Amount : ........... Cheque amount : ...........

Submitted by : ........... Approved by : ...........

Position : ........... Position : ...........

Date : ........... Date : ...........

If all of the above discussed deductions made in the same entry

Prepare a journal voucher (AGF No. 10 ) of a government office from the information

as follows:

Cheque issued for Rs. 6,00,000 as salary for the month of Asoj 2072, after a deducting

provident fund Rs. 60,000; provident fund loan Rs. 20,000; income tax Rs. 5,000;

personnel loan Rs. 10,000 and citizen investment fund Rs. 5,000. Deposited deducted

amount in the concerned office same day.

Government of Nepal

…………………Office/Department/Ministry

AGF No. 10 J.V.No.: .........

Code B.H. Debit Credit

No. Particulars L.F. No. (Rs.) (Rs.)

Dr. B.E. Salary 21111 7,00,000

Cr. Provident fund 60,000

Cr. Provident fund loan 20,000

Cr. Income Tax 5,000

Cr. Personnel loan 10,000

Cr. Citizen Investment Fund 5,000

Cr. N.R. Bank 6,00,000

(Being distribution of salary after

deduction of various items)

Dr. Provident fund 60,000

Dr. Provident fund loan 20,000

Dr. Income tax 5,000

Dr. Personnel loan 10,000

Dr. Citizen Investment Fund 5,000

Cr. N.R. Bank 1,00,000

(Being various deductions deposited into

concerned offices)

Total 8,00,000 8,00,000

Office Practice and Accounting 10 207