Page 211 - Office Practice and Accounting 10

P. 211

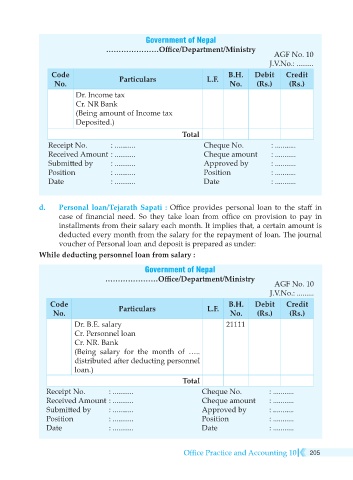

Government of Nepal

…………………Office/Department/Ministry

AGF No. 10

J.V.No.: .........

Code Particulars L.F. B.H. Debit Credit

No. No. (Rs.) (Rs.)

Dr. Income tax

Cr. NR Bank

(Being amount of Income tax

Deposited.)

Total

Receipt No. : ........... Cheque No. : ...........

Received Amount : ........... Cheque amount : ...........

Submitted by : ........... Approved by : ...........

Position : ........... Position : ...........

Date : ........... Date : ...........

d. Personal loan/Tejarath Sapati : Office provides personal loan to the staff in

case of financial need. So they take loan from office on provision to pay in

installments from their salary each month. It implies that, a certain amount is

deducted every month from the salary for the repayment of loan. The journal

voucher of Personal loan and deposit is prepared as under:

While deducting personnel loan from salary :

Government of Nepal

…………………Office/Department/Ministry

AGF No. 10

J.V.No.: .........

Code B.H. Debit Credit

No. Particulars L.F. No. (Rs.) (Rs.)

Dr. B.E. salary 21111

Cr. Personnel loan

Cr. NR. Bank

(Being salary for the month of …..

distributed after deducting personnel

loan.)

Total

Receipt No. : ........... Cheque No. : ...........

Received Amount : ........... Cheque amount : ...........

Submitted by : ........... Approved by : ...........

Position : ........... Position : ...........

Date : ........... Date : ...........

Office Practice and Accounting 10 205