Page 189 - Office Practice and Accounting -9

P. 189

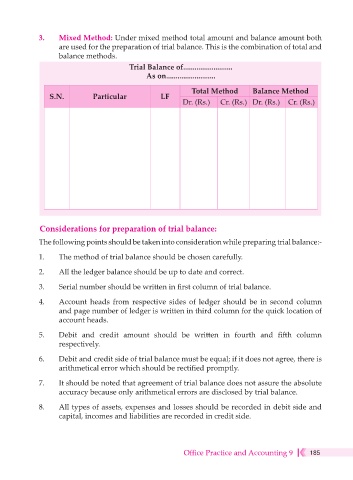

3. Mixed Method: Under mixed method total amount and balance amount both

are used for the preparation of trial balance. This is the combination of total and

balance methods.

Trial Balance of..........................

As on..........................

Total Method Balance Method

S.N. Particular LF

Dr. (Rs.) Cr. (Rs.) Dr. (Rs.) Cr. (Rs.)

Considerations for preparation of trial balance:

The following points should be taken into consideration while preparing trial balance:-

1. The method of trial balance should be chosen carefully.

2. All the ledger balance should be up to date and correct.

3. Serial number should be written in first column of trial balance.

4. Account heads from respective sides of ledger should be in second column

and page number of ledger is written in third column for the quick location of

account heads.

5. Debit and credit amount should be written in fourth and fifth column

respectively.

6. Debit and credit side of trial balance must be equal; if it does not agree, there is

arithmetical error which should be rectified promptly.

7. It should be noted that agreement of trial balance does not assure the absolute

accuracy because only arithmetical errors are disclosed by trial balance.

8. All types of assets, expenses and losses should be recorded in debit side and

capital, incomes and liabilities are recorded in credit side.

Office Practice and Accounting 9 185