Page 190 - Office Practice and Accounting -9

P. 190

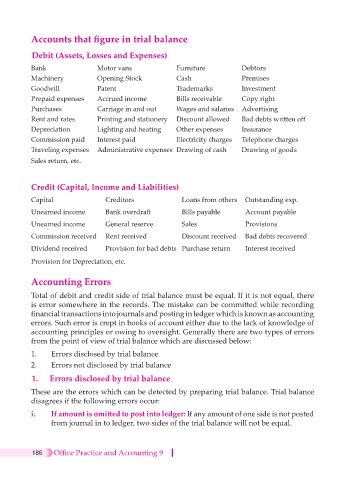

Accounts that figure in trial balance

Debit (Assets, Losses and Expenses)

Bank Motor vans Furniture Debtors

Machinery Opening Stock Cash Premises

Goodwill Patent Trademarks Investment

Prepaid expenses Accrued income Bills receivable Copy right

Purchases Carriage in and out Wages and salaries Advertising

Rent and rates Printing and stationery Discount allowed Bad debts written off

Depreciation Lighting and heating Other expenses Insurance

Commission paid Interest paid Electricity charges Telephone charges

Traveling expenses Administrative expenses Drawing of cash Drawing of goods

Sales return, etc.

Credit (Capital, Income and Liabilities)

Capital Creditors Loans from others Outstanding exp.

Unearned income Bank overdraft Bills payable Account payable

Unearned income General reserve Sales Provisions

Commission received Rent received Discount received Bad debts recovered

Dividend received Provision for bad debts Purchase return Interest received

Provision for Depreciation, etc.

Accounting Errors

Total of debit and credit side of trial balance must be equal. If it is not equal, there

is error somewhere in the records. The mistake can be committed while recording

financial transactions into journals and posting in ledger which is known as accounting

errors. Such error is crept in books of account either due to the lack of knowledge of

accounting principles or owing to oversight. Generally there are two types of errors

from the point of view of trial balance which are discussed below:

1. Errors disclosed by trial balance

2. Errors not disclosed by trial balance

1. Errors disclosed by trial balance

These are the errors which can be detected by preparing trial balance. Trial balance

disagrees if the following errors occur:

i. If amount is omitted to post into ledger: If any amount of one side is not posted

from journal in to ledger, two sides of the trial balance will not be equal.

186 Office Practice and Accounting 9