Page 192 - Office Practice and Accounting -9

P. 192

iii. Compensating error: When one error is compensated or overlapped by another

error of same amount such error is known as compensating error. e.g. payment

of salary Rs. 6000 is recorded in debit correctly but as Rs. 600 in credit and

payment of commission Rs. 600 recorded again correctly in debit but recorded

Rs. 6000 in credit. Here in first case, credit side less recorded by Rs. 5400

wrongly but next time again wrongly, cash is over recorded by Rs. 5400 which

compensates the previous error.

iv. Errors of duplication: An error of duplication occurs when the same transaction

has been recorded twice in the books of original entry and also posted twice in

the ledger. e.g. Purchase worth Rs. 7000 may be recorded twice in the accounts.

v. Errors of principle: Errors of principle occur due to the violation of fundamental

principles of accounting. This may be due to lack of correct knowledge of

the accounting principle on the part of the recording clerks. E.g. salary paid

recorded in wages, purchase of assets recorded in purchase book, etc.

Illustrations

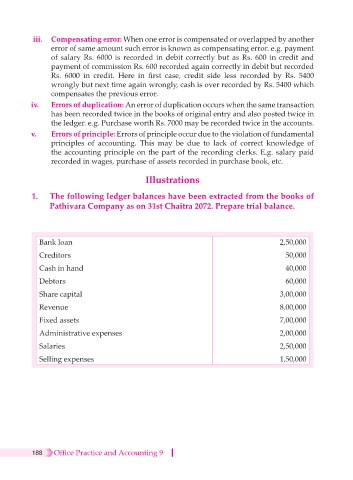

1. The following ledger balances have been extracted from the books of

Pathivara Company as on 31st Chaitra 2072. Prepare trial balance.

Bank loan 2,50,000

Creditors 50,000

Cash in hand 40,000

Debtors 60,000

Share capital 3,00,000

Revenue 8,00,000

Fixed assets 7,00,000

Administrative expenses 2,00,000

Salaries 2,50,000

Selling expenses 1,50,000

188 Office Practice and Accounting 9