Page 126 - SFG_ANNUALREPORT_12OCT_SINGLEPAGE

P. 126

NOTES TO THE FINANCIAL STATEMENTS (CONT.)

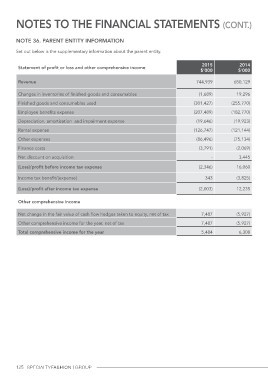

Note 36. Parent entity information

Set out below is the supplementary information about the parent entity.

Statement of profit or loss and other comprehensive income 2015 2014

$’000 $’000

Revenue

744,939 650,129

Changes in inventories of finished goods and consumables

Finished goods and consumables used (1,689) 19,296

Employee benefits expense (301,427) (255,770)

Depreciation, amortisation and impairment expense (207,489) (182,770)

Rental expense

Other expenses (19,646) (19,923)

Finance costs (126,747) (121,144)

Net discount on acquisition

(Loss)/profit before income tax expense (86,496) (75,134)

Income tax benefit/(expense) (3,791) (2,069)

(Loss)/profit after income tax expense - 3,445

(2,346) 16,060

343 (3,825)

(2,003) 12,235

Other comprehensive income 7,487 (5,927)

7,487 (5,927)

Net change in the fair value of cash flow hedges taken to equity, net of tax 5,484

Other comprehensive income for the year, net of tax 6,308

Total comprehensive income for the year

125