Page 121 - SFG_ANNUALREPORT_12OCT_SINGLEPAGE

P. 121

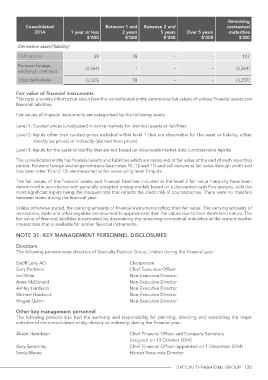

Consolidated 1 year or less Between 1 and Between 2 and Over 5 years Remaining

2014 $’000 2 years 5 years $’000 contractual

$’000 $’000

Derivative asset/(liability) - maturities

78 - - $’000

Call options 29 -

- - 107

Forward foreign (3,364)

exchange contracts 78 - (3,364)

Total derivatives (3,335) (3,257)

Fair value of financial instruments

This note provides information about how the consolidated entity determines fair values of various financial assets and

financial liabilities.

Fair values of financial instruments are categorised by the following levels:

Level 1: Quoted prices (unadjusted) in active markets for identical assets or liabilities

Level 2: Inputs other than quoted prices included within level 1 that are observable for the asset or liability, either

directly (as prices) or indirectly (derived from prices)

Level 3: Inputs for the asset or liability that are not based on observable market data (unobservable inputs)

The consolidated entity has financial assets and liabilities which are measured at fair value at the end of each reporting

period. Forward foreign exchange contracts (see notes 10, 12 and 17) and call options at fair value through profit and

loss (see notes 10 and 12) are measured at fair value using level 2 inputs.

The fair values of the financial assets and financial liabilities included in the level 2 fair value hierarchy have been

determined in accordance with generally accepted pricing models based on a discounted cash flow analysis, with the

most significant inputs being the discount rate that reflects the credit risk of counterparties. There were no transfers

between levels during the financial year.

Unless otherwise stated, the carrying amounts of financial instruments reflect their fair value. The carrying amounts of

receivables, trade and other payables are assumed to approximate their fair values due to their short-term nature. The

fair value of financial liabilities is estimated by discounting the remaining contractual maturities at the current market

interest rate that is available for similar financial instruments.

Note 31. Key management personnel disclosures

Directors

The following persons were directors of Specialty Fashion Group Limited during the financial year:

Geoff Levy AO Chairperson

Gary Perlstein Chief Executive Officer

Ian Miller Non-Executive Director

Anne McDonald Non-Executive Director

Ashley Hardwick Non-Executive Director

Michael Hardwick Non-Executive Director

Megan Quinn Non-Executive Director

Other key management personnel

The following persons also had the authority and responsibility for planning, directing and controlling the major

activities of the consolidated entity, directly or indirectly, during the financial year:

Alison Henriksen Chief Financial Officer and Company Secretary

(resigned on 13 October 2014)

Gary Spreckley Chief Financial Officer (appointed on 1 December 2014)

Sonia Moura Human Resources Director

120