Page 124 - SFG_ANNUALREPORT_12OCT_SINGLEPAGE

P. 124

NOTES TO THE FINANCIAL STATEMENTS (CONT.)

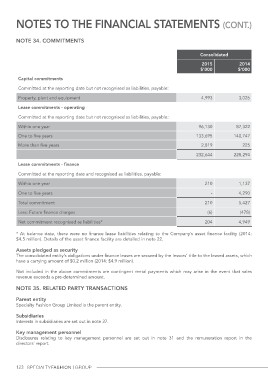

Note 34. Commitments

Consolidated 2014

$’000

2015

$’000

Capital commitments 4,993 3,026

Committed at the reporting date but not recognised as liabilities, payable:

Property, plant and equipment 96,130 87,322

Lease commitments - operating 133,695 140,747

Committed at the reporting date but not recognised as liabilities, payable:

Within one year 2,819 225

One to five years 232,644 228,294

More than five years

210 1,137

Lease commitments - finance - 4,290

Committed at the reporting date and recognised as liabilities, payable:

Within one year 210 5,427

One to five years (6) (478)

Total commitment

Less: Future finance charges 204 4,949

Net commitment recognised as liabilities*

* At balance date, there were no finance lease liabilities relating to the Company’s asset finance facility (2014:

$4.5 million). Details of the asset finance facility are detailed in note 22.

Assets pledged as security

The consolidated entity’s obligations under finance leases are secured by the lessors’ title to the leased assets, which

have a carrying amount of $0.2 million (2014: $4.9 million).

Not included in the above commitments are contingent rental payments which may arise in the event that sales

revenue exceeds a pre-determined amount.

Note 35. Related party transactions

Parent entity

Specialty Fashion Group Limited is the parent entity.

Subsidiaries

Interests in subsidiaries are set out in note 37.

Key management personnel

Disclosures relating to key management personnel are set out in note 31 and the remuneration report in the

directors’ report.

123