Page 9 - The Pulse Issue 4

P. 9

Buy to Let 2016: Buy to Let 2017:

Market Changes Market Changes & Forecast

Stamp Duty Hike PRA Changes Come into Force

January 2017

April 2016

% The government increased stamp duty by 3% for those buying second By 1st January 2017 all lenders will need to have implemented the

homes and buy to let properties. new affordability and ICR models, introduced by the PRA.

Wear and Tear Mortgage Interest Tax Relief Cuts

April 2016 April 2017

At the moment landlords can claim back a percentage of their

Landlords previously were allowed to deduct an annual allowance from mortgage interest costs, equal to the amount of tax they pay. Those

their taxable profits for wear and tear. This allowance was permitted who pay basic rate tax can claim 20% of the mortgage interest

regardless of whether any improvements to the property needed to be however those who pay the highest rate of tax can claim back 45%.

made.

George Osborne announced in the Summer 2015 Budget that starting

From April 2016, landlords will need to provide itemised receipts if from April 2017 all landlords will only be able to reclaim 20 per cent -

they wish for the costs to be deducted from their tax. regardless of the level of tax they pay. This change will be phased in

over a four year period.

House Price Rise

December 2016 Rise in Limited Company Buy to Lets

The British property market is now worth a whopping £8.17 trillion

after rising 7% since the start of the year, according to new data from Anyone holding properties in a limited company name will be

property website Zoopla. unaffected by a number of the changes coming in to play in 2017. For

example, the mortgage interest for buy to lets in a limited company

For the average British home this works out at a rise of over £19,000 name will remain tax deductible and the corporate tax rate is a flat

during 2016, or £57 per day. 20%, falling to 17% in the next five years. In addition to this, limited

companies will not be affected by the new affordability stress test

changes, meaning lenders can keep their rental calculation at 125%.

These factors may drive a continued surge in sales in this area.

Affordability Tests Get Tougher

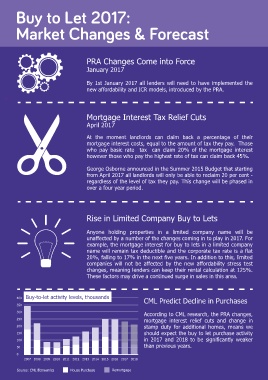

December 2016 400 Buy-to-let activity levels, thousands CML Predict Decline in Purchases

350

The Prudential Regulation Authority (PRA) proposed tighter interest 300

rate affordability stress tests are introduced from January 2017. This According to CML research, the PRA changes,

resulted in lenders towards the end of 2016, increasing their rental 250 mortgage interest relief cuts and change in

cover from 125% at 5% to 145% at 5.5%, sometimes even higher. 200 stamp duty for additional homes, means we

150 should expect the buy to let purchase activity

This means that landlords borrowing funds in their own individual 100 in 2017 and 2018 to be significantly weaker

name will face tougher stress test calculations which will result in the 50 than previous years.

amount they will be able to borrow being reduced. 0

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

Source: CML Economics House Purchase Remortgage