Page 79 - AR201718

P. 79

THE SOUTH AFRICAN INSTITUTE FOR DRUG-FREE SPORT THE SOUTH AFRICAN INSTITUTE FOR DRUG-FREE SPORT

NOTES TO THE FINANCIAL STATEMENTS (continued) NOTES TO THE FINANCIAL STATEMENTS (continued)

1. ACCOUNTING POLICIES (continued) 1. ACCOUNTING POLICIES (continued)

1.4 PROPERTY, PLANT AND EQUIPMENT (continued) 1.5 INTANGIBLE ASSETS (continued)

Depreciation is calculated on a straight-line basis over the useful life of the asset. An annual assessment, at the reporting date, is calculated on intangible assets to determine if the assets are

impaired.

The useful lives are:

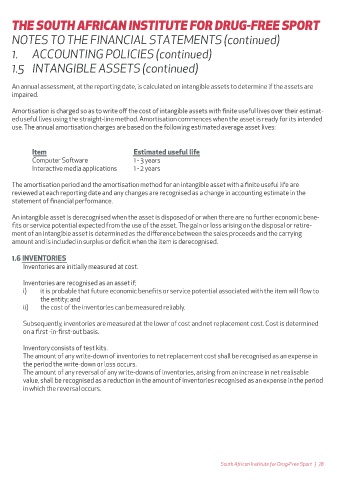

Item Estimated useful life Amortisation is charged so as to write off the cost of intangible assets with finite useful lives over their estimat-

Computer Equipment 3 yrs ed useful lives using the straight-line method. Amortisation commences when the asset is ready for its intended

Furniture and Fit ings 3 - 6 yrs use. The annual amortisation charges are based on the following estimated average asset lives:

Motor Vehicles 4 - 6 yrs

Office Equipment 1.5 - 6 yrs

Leasehold Improvements 5 yrs Item Estimated useful life

Computer Sof ware 1 - 3 years

The residual values, useful lives and depreciation method of property, plant and equipment are reviewed on an Interactive media applications 1 - 2 years

annual basis. Profits and losses on disposal of property, plant and equipment are credited and charged to the

statement of financial performance. The assets are reviewed for impairment on an annual basis. When events or The amortisation period and the amortisation method for an intangible asset with a finite useful life are

changes in circumstances indicate that the carrying value may not be recoverable, the assets are writ en down reviewed at each reporting date and any changes are recognised as a change in accounting estimate in the

to their recoverable amount and any adjustments shall be recognised immediately in surplus or deficit; unless statement of financial performance.

the asset is carried at a revalued amount, in which case the decrease shall be debited directly in net assets to

the extent any credit balance exists in the revaluation surplus in respect of that asset. Property, plant and An intangible asset is derecognised when the asset is disposed of or when there are no further economic bene-

equipment is derecognised on disposal or when no future economic benefits or service potential are expected fits or service potential expected from the use of the asset. The gain or loss arising on the disposal or retire-

from its use or disposal. The gain or loss arising from the derecognition is included in surplus or deficit when the ment of an intangible asset is determined as the difference between the sales proceeds and the carrying

item is derecognised. Gains and losses on disposals are determined by comparing proceeds with carrying amount and is included in surplus or deficit when the item is derecognised.

amounts and are recognised in profit or loss in the period.

1.6 INVENTORIES

1.5 INTANGIBLE ASSETS Inventories are initially measured at cost.

An intangible asset is recognised when:

i) it is probable that the expected future economic benefits or service potential that are at ributable to the Inventories are recognised as an asset if;

asset will flow to the entity; and i) it is probable that future economic benefits or service potential associated with the item will flow to

ii) the cost or fair value of the asset can be measured reliably. the entity; and

ii) the cost of the inventories can be measured reliably.

Intangible assets are initially recognised at cost. Subsequent to initial recognition, intangible assets are

carried at cost less accumulated amortisation and accumulated impairment losses. The cost (or depreciable Subsequently, inventories are measured at the lower of cost and net replacement cost. Cost is determined

amount) of intangible assets with finite useful lives is amortised over the estimated useful lives. on a first -in-first-out basis.

The residual value of an intangible asset with a finite useful life shall be assumed to be zero unless: Inventory consists of test kits.

The amount of any write-down of inventories to net replacement cost shall be recognised as an expense in

a) there is a commitment by a third party to acquire the asset at the end of its useful life; or the period the write-down or loss occurs.

b) there is an active market for the asset; and The amount of any reversal of any write-downs of inventories, arising from an increase in net realisable

i) residual value can be determined by reference to that market; and value, shall be recognised as a reduction in the amount of inventories recognised as an expense in the period

ii) it is probable that such a market will exist at the end of the asset's useful life. in which the reversal occurs.

77 | South African Institute for Drug-Free Sport South African Institute for Drug-Free Sport | 78