Page 9 - Traditions Policies and Procedures

P. 9

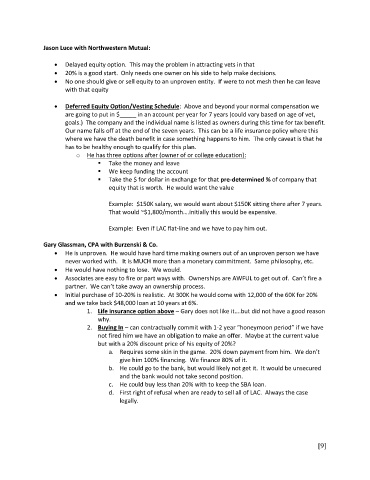

Jason Luce with Northwestern Mutual:

Delayed equity option. This may the problem in attracting vets in that

20% is a good start. Only needs one owner on his side to help make decisions.

No one should give or sell equity to an unproven entity. If were to not mesh then he can leave

with that equity

Deferred Equity Option/Vesting Schedule: Above and beyond your normal compensation we

are going to put in $_____ in an account per year for 7 years (could vary based on age of vet,

goals.) The company and the individual name is listed as owners during this time for tax benefit.

Our name falls off at the end of the seven years. This can be a life insurance policy where this

where we have the death benefit in case something happens to him. The only caveat is that he

has to be healthy enough to qualify for this plan.

o He has three options after (owner of or college education):

Take the money and leave

We keep funding the account

Take the $ for dollar in exchange for that pre-determined % of company that

equity that is worth. He would want the value

Example: $150K salary, we would want about $150K sitting there after 7 years.

That would ~$1,800/month….initially this would be expensive.

Example: Even if LAC flat-line and we have to pay him out.

Gary Glassman, CPA with Burzenski & Co.

He is unproven. He would have hard time making owners out of an unproven person we have

never worked with. It is MUCH more than a monetary commitment. Same philosophy, etc.

He would have nothing to lose. We would.

Associates are easy to fire or part ways with. Ownerships are AWFUL to get out of. Can’t fire a

partner. We can’t take away an ownership process.

Initial purchase of 10-20% is realistic. At 300K he would come with 12,000 of the 60K for 20%

and we take back $48,000 loan at 10 years at 6%.

1. Life insurance option above – Gary does not like it….but did not have a good reason

why.

2. Buying In – can contractually commit with 1-2 year “honeymoon period” if we have

not fired him we have an obligation to make an offer. Maybe at the current value

but with a 20% discount price of his equity of 20%?

a. Requires some skin in the game. 20% down payment from him. We don’t

give him 100% financing. We finance 80% of it.

b. He could go to the bank, but would likely not get it. It would be unsecured

and the bank would not take second position.

c. He could buy less than 20% with to keep the SBA loan.

d. First right of refusal when are ready to sell all of LAC. Always the case

legally.

[9]