Page 19 - 2017-08 CPE Flip Book_Neat

P. 19

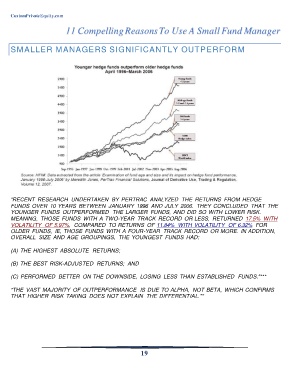

11 Compelling Reasons To Use A Small Fund Manager

SMALLER MANAGERS SIGNIFICANTLY OUTPERFORM

“RECENT RESEARCH UNDERTAKEN BY PERTRAC ANALYZED THE RETURNS FROM HEDGE

FUNDS OVER 10 YEARS BETWEEN JANUARY 1996 AND JULY 2006. THEY CONCLUDED THAT THE

YOUNGER FUNDS OUTPERFORMED THE LARGER FUNDS, AND DID SO WITH LOWER RISK.

MEANING, THOSE FUNDS WITH A TWO-YEAR TRACK RECORD OR LESS, RETURNED 17.5% WITH

VOLATILITY OF 5.97%, COMPARED TO RETURNS OF 11.84% WITH VOLATILITY OF 6.32% FOR

OLDER FUNDS, IE, THOSE FUNDS WITH A FOUR-YEAR TRACK RECORD OR MORE. IN ADDITION,

OVERALL SIZE AND AGE GROUPINGS, THE YOUNGEST FUNDS HAD:

(A) THE HIGHEST ABSOLUTE RETURNS;

(B) THE BEST RISK-ADJUSTED RETURNS; AND

(C) PERFORMED BETTER ON THE DOWNSIDE, LOSING LESS THAN ESTABLISHED FUNDS."***

"THE VAST MAJORITY OF OUTPERFORMANCE IS DUE TO ALPHA, NOT BETA, WHICH CONFIRMS

THAT HIGHER RISK TAKING DOES NOT EXPLAIN THE DIFFERENTIAL."*

19