Page 20 - 2017-08 CPE Flip Book_Neat

P. 20

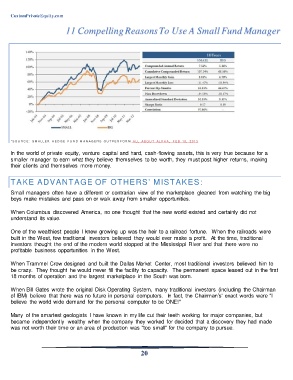

11 Compelling Reasons To Use A Small Fund Manager

* S O U R C E : S M A L L E R H E D G E F U N D M A N A G E R S O U T P E R F O R M A L L A B O U T A L P H A , F E B 1 8 , 2 0 1 3

In the world of private equity, venture capital and hard, cash-flowing assets, this is very true because for a

smaller manager to earn what they believe themselves to be worth, they must post higher returns, making

their clients and themselves more money.

TAKE ADVANTAGE OF OTHERS’ MISTAKES:

Small managers often have a different or contrarian view of the marketplace gleaned from watching the big

boys make mistakes and pass on or walk away from smaller opportunities.

When Columbus discovered America, no one thought that the new world existed and certainly did not

understand its value.

One of the wealthiest people I knew growing up was the heir to a railroad fortune. When the railroads were

built in the West, few traditional investors believed they would ever make a profit. At the time, traditional

investors thought the end of the modern world stopped at the Mississippi River and that there were no

profitable business opportunities in the West.

When Trammel Crow designed and built the Dallas Market Center, most traditional investors believed him to

be crazy. They thought he would never fill the facility to capacity. The permanent space leased out in the first

18 months of operation and the largest marketplace in the South was born.

When Bill Gates wrote the original Disk Operating System, many traditional investors (including the Chairman

of IBM) believe that there was no future in personal computers. In fact, the Chairman’s' exact words were "I

believe the world wide demand for the personal computer to be ONE!"

Many of the smartest geologists I have known in my life cut their teeth working for major companies, but

became independently wealthy when the company they worked for decided that a discovery they had made

was not worth their time or an area of production was "too small" for the company to pursue.

20