Page 47 - Forbes - Asia (April 2019)

P. 47

Yet others believe Rakuten’s mobile service will give it an

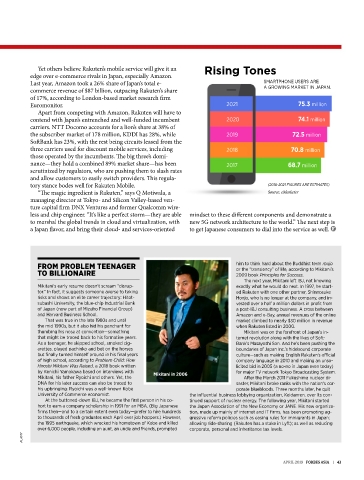

edge over e-commerce rivals in Japan, especially Amazon. Rising Tones

Last year, Amazon took a 26% share of Japan’s total e- SMARTPHONE USERS ARE

A GROWING MARKET IN JAPAN.

commerce revenue of $87 billion, outpacing Rakuten’s share

of 17%, according to London-based market research firm

Euromonitor. 2021 75.3 million

Apart from competing with Amazon, Rakuten will have to

contend with Japan’s entrenched and well-funded incumbent 2020 74.1 million

carriers. NTT Docomo accounts for a lion’s share at 38% of

the subscriber market of 178 million, KDDI has 28%, while 2019 72.5 million

SoftBank has 23%, with the rest being circuits leased from the

three carriers used for discount mobile services, including 2018 70.8 million

those operated by the incumbents. The big three’s domi-

nance—they hold a combined 89% market share—has been 2017 68.7 million

scrutinized by regulators, who are pushing them to slash rates

and allow customers to easily switch providers. This regula-

tory stance bodes well for Rakuten Mobile. (2018-2021 FIGURES ARE ESTIMATES)

“The magic ingredient is Rakuten,” says Q Motiwala, a Source: eMarketer

managing director at Tokyo- and Silicon Valley-based ven-

ture capital firm DNX Ventures and former Qualcomm wire-

less and chip engineer. “It’s like a perfect storm—they are able mindset to these different components and demonstrate a

to marshal the global trends in cloud and virtualization, with new 5G network architecture to the world.” The next step is

a Japan flavor, and bring their cloud- and services-oriented to get Japanese consumers to dial into the service as well. F

FROM PROBLEM TEENAGER him to think hard about the Buddhist term mujo

TO BILLIONAIRE or the “transiency” of life, according to Mikitani’s

2009 book Principles for Success.

The next year, Mikitani left IBJ, not knowing

Mikitani’s early resume doesn’t scream “disrup- exactly what he would do next. In 1997, he start-

tor.” In fact, it suggests someone averse to taking ed Rakuten with one other partner, Shinnosuke

risks and shows an elite career trajectory: Hitot- Honjo, who is no longer at the company, and in-

subashi University, the blue-chip Industrial Bank vested over a half a million dollars in profit from

of Japan (now part of Mizuho Financial Group) a post-IBJ consulting business. A cross between

and Harvard Business School. Amazon and e-Bay, annual revenues of the online

That was true in the late 1980s and until market climbed to nearly $30 million in revenue

the mid 1990s, but it also hid his penchant for when Rakuten listed in 2000.

thumbing his nose at convention—something Mikitani was on the forefront of Japan’s in-

that might be traced back to his formative years. ternet revolution along with the likes of Soft-

As a teenager, he skipped school, smoked cig- Bank’s Masayoshi Son. And he’s been pushing the

arettes, played pachinko and bet on the horses boundaries of Japan Inc.’s hidebound corporate

but finally turned himself around in his final years culture—such as making English Rakuten’s official

of high school, according to Problem Child: How company language in 2010 and making an unso-

Hiroshi Mikitani Was Raised, a 2018 book written licited bid in 2005 (a no-no in Japan even today)

by Kenichi Yamakawa based on interviews with Mikitani in 2006 for major TV network Tokyo Broadcasting System.

Mikitani, his father Ryoichi and others. Yet, the After the March 2011 Fukushima nuclear di-

DNA for his later success can also be traced to saster, Mikitani broke ranks with the nation’s cor-

his upbringing: Ryoichi was a well-known Kobe porate bluebloods. Three months later, he quit

University of Commerce economist. the influential business lobbying organization, Keidanren, over its con-

At the buttoned-down IBJ, he became the first person in his co- tinued support of nuclear energy. The following year, Mikitani started

hort to earn a company scholarship in 1991 for an MBA. (Big Japanese the Japan Association of the New Economy or JANE. His new organiza-

firms then—and to a certain extent even today—prefer to hire hundreds tion, made up mainly of internet and IT firms, has been promoting ag-

to thousands of fresh graduates each April over job hoppers.) However, gressive reform policies such as easing rules for immigrants in Japan;

the 1995 earthquake, which wrecked his hometown of Kobe and killed allowing ride-sharing (Rakuten has a stake in Lyft); as well as reducing

over 6,000 people, including an aunt, an uncle and friends, prompted corporate, personal and inheritance tax levels.

ALAMY

APRIL 2019 FORBES ASIA | 43