Page 20 - Forbes - Asia (October 2019)

P. 20

ENTREPRENEURS

Restrictions by Beijing and Can- the new housing stock in New South as now, due to a leasing strategy that

berra were meant to crimp demand. In Wales, the state in which Sydney is lo- provides profits when demand is weak.

2015, on concerns that international de- cated and where Meriton is most active, During a similar downturn in the 1970s,

mand was making home prices unaf- according to Credit Suisse. Triguboff offset lower sales for Meriton’s

fordable for its citizens, the Australian Purchases from Chinese investors new apartments by keeping some of its

government limited nonresident inves- have declined more recently as Aus- dwellings and renting them out rath-

tors to purchasing newly built proper- tralian regulators increased taxes and er than selling them. To this day, Meri-

ties, vacant land or residences still on stamp duty on foreign buyers, more ton retains ownership of slightly more

the drawing board, or “off-plan.” Inter- than doubling surcharges in some in- than a tenth of the dwellings it builds, a

national buyers face other restrictions: stances. Simultaneously, the Chinese roughly A$3 billion portfolio of proper-

approval from the Foreign Investment government introduced stricter cap- ties that makes Meriton Australia’s big-

Review Board for their purchase; up to gest landlord. So when property pric-

40% deposit on purchase prices before es rise, so does Triguboff’s net worth;

banks will give a mortgage; and various Triguboff does well when the market is volatile, his rent-

fees, taxes and stamp duties. al income is the backstop. “Leasing is a

Despite the barriers, Australian even in rare downturns huge area for us and one where we are

property remains attractive to interna- in Australian property. growing,” he says.

tional buyers, particularly from China, Meriton’s yield income is helped by

who want to safely park funds offshore its strategy to build projects in suburbs

in an appreciating asset. Wealthy Chi- ital controls to reduce renminbi out- close to the central business district

nese can also take advantage of Austra- flows. But Triguboff says that no matter that command premium rents, accord-

lia’s investor visa schemes, a pathway to how difficult Beijing or Canberra make ing to Michelle Ciesielski, head of res-

permanent residency for those willing it, Chinese buyers will remain attract- idential research at Knight Frank Aus-

to bankroll Australian-based enterpris- ed to Australian property. “The Chinese tralia. “This increased rental supply has

es. The Significant Investor Visa, requir- always know how to find the way to certainly aided locals wanting to live

ing an investment of A$5 million (not overcome anything,” he says. “So even close to where they work and play,” she

including real estate), has been granted though our banks may not give them says. While other developers have the

2,022 times since the scheme’s inception much money, and maybe their govern- same strategy, Meriton retains a higher

in 2012, with 87% of recipients being ment doesn’t let them take much money portion of its own units than others for

mainland Chinese, according to Aus- [out of China], they usually find a way rent, she says.

tralia’s Department of Home Affairs. to invest.” Triguboff is confident the market will

In 2017, international buyers—77% of Triguboff does well even in rare revive soon and prices with it, as bar-

them from China—bought a quarter of downturns in Australian property, such gains lure buyers and banks relax recent

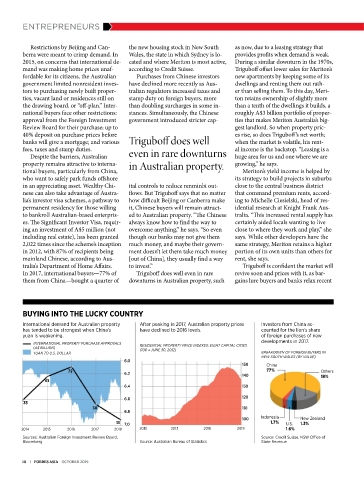

BUYING INTO THE LUCKY COUNTRY

International demand for Australian property After peaking in 2017, Australian property prices Investors from China ac-

has tended to be strongest when China’s have declined to 2016 levels. counted for the lion’s share

yuan is weakening. of foreign purchases of new

developments in 2017.

INTERNATIONAL PROPERTY PURCHASE APPROVALS RESIDENTIAL PROPERTY PRICE INDEXES: EIGHT CAPITAL CITIES

(A$ BILLION)

(100 = JUNE 30, 2012)

YUAN TO U.S. DOLLAR BREAKDOWN OF FOREIGN BUYERS IN

NEW SOUTH WALES (BY VALUE)

6.0

150 China

72 77% Others

6.2

140 18%

61

6.4 130

6.6 120

35

30 110

6.8

Indonesia

100 New Zealand

13 7.0 1.7% U.S. 1.3%

2014 2015 2016 2017 2018 2010 2013 2016 2019 1.6%

Sources: Australian Foreign Investment Review Board, Source: Credit Suisse, NSW Office of

Bloomberg Source: Australian Bureau of Statistics State Revenue

18 | FORBES ASIA OCTOBER 2019