Page 59 - MBA curriculum and syllabus R2017 - REC

P. 59

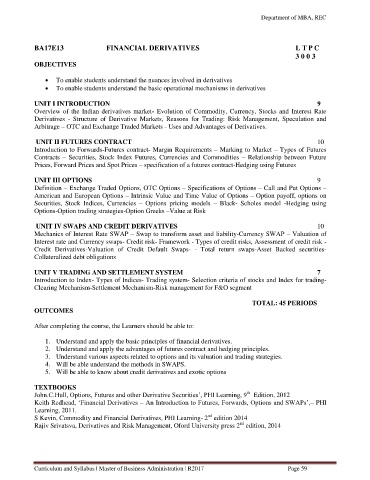

Department of MBA, REC

BA17E13 FINANCIAL DERIVATIVES L T P C

3 0 0 3

OBJECTIVES

To enable students understand the nuances involved in derivatives

To enable students understand the basic operational mechanisms in derivatives

UNIT I INTRODUCTION 9

Overview of the Indian derivatives market- Evolution of Commodity, Currency, Stocks and Interest Rate

Derivatives - Structure of Derivative Markets, Reasons for Trading: Risk Management, Speculation and

Arbitrage – OTC and Exchange Traded Markets - Uses and Advantages of Derivatives.

UNIT II FUTURES CONTRACT 10

Introduction to Forwards-Futures contract- Margin Requirements – Marking to Market – Types of Futures

Contracts – Securities, Stock Index Futures, Currencies and Commodities – Relationship between Future

Prices, Forward Prices and Spot Prices – specification of a futures contract-Hedging using Futures

UNIT III OPTIONS 9

Definition – Exchange Traded Options, OTC Options – Specifications of Options – Call and Put Options –

American and European Options – Intrinsic Value and Time Value of Options – Option payoff, options on

Securities, Stock Indices, Currencies – Options pricing models – Black- Scholes model -Hedging using

Options-Option trading strategies-Option Greeks –Value at Risk

UNIT IV SWAPS AND CREDIT DERIVATIVES 10

Mechanics of Interest Rate SWAP – Swap to transform asset and liability-Currency SWAP – Valuation of

Interest rate and Currency swaps- Credit risk- Framework - Types of credit risks, Assessment of credit risk -

Credit Derivatives-Valuation of Credit Default Swaps- - Total return swaps-Asset Backed securities-

Collateralized debt obligations

UNIT V TRADING AND SETTLEMENT SYSTEM 7

Introduction to Index- Types of Indices- Trading system- Selection criteria of stocks and Index for trading-

Clearing Mechanism-Settlement Mechanism-Risk management for F&O segment

TOTAL: 45 PERIODS

OUTCOMES

After completing the course, the Learners should be able to:

1. Understand and apply the basic principles of financial derivatives.

2. Understand and apply the advantages of futures contract and hedging principles.

3. Understand various aspects related to options and its valuation and trading strategies.

4. Will be able understand the methods in SWAPS.

5. Will be able to know about credit derivatives and exotic options

TEXTBOOKS

th

John.C.Hull, Options, Futures and other Derivative Securities’, PHI Learning, 9 Edition, 2012

Keith Redhead, ‘Financial Derivatives – An Introduction to Futures, Forwards, Options and SWAPs’,– PHI

Learning, 2011.

nd

S Kevin, Commodity and Financial Derivatives, PHI Learning- 2 edition 2014

nd

Rajiv Srivatsva, Derivatives and Risk Management, Oford University press 2 edition, 2014

Curriculum and Syllabus | Master of Business Administration | R2017 Page 59