Page 62 - MBA curriculum and syllabus R2017 - REC

P. 62

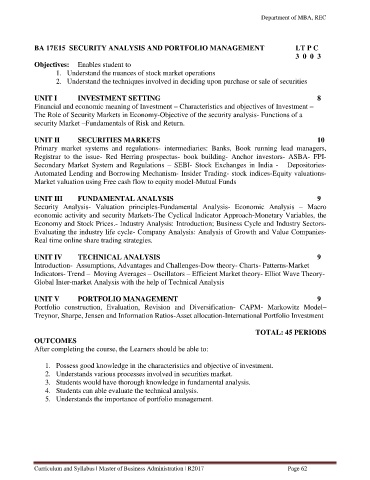

Department of MBA, REC

BA 17E15 SECURITY ANALYSIS AND PORTFOLIO MANAGEMENT LT P C

3 0 0 3

Objectives: Enables student to

1. Understand the nuances of stock market operations

2. Understand the techniques involved in deciding upon purchase or sale of securities

UNIT I INVESTMENT SETTING 8

Financial and economic meaning of Investment – Characteristics and objectives of Investment –

The Role of Security Markets in Economy-Objective of the security analysis- Functions of a

security Market –Fundamentals of Risk and Return.

UNIT II SECURITIES MARKETS 10

Primary market systems and regulations- intermediaries: Banks, Book running lead managers,

Registrar to the issue- Red Herring prospectus- book building- Anchor investors- ASBA- FPI-

Secondary Market System and Regulations – SEBI- Stock Exchanges in India - Depositories-

Automated Lending and Borrowing Mechanism- Insider Trading- stock indices-Equity valuations-

Market valuation using Free cash flow to equity model-Mutual Funds

UNIT III FUNDAMENTAL ANALYSIS 9

Security Analysis- Valuation principles-Fundamental Analysis- Economic Analysis – Macro

economic activity and security Markets-The Cyclical Indicator Approach-Monetary Variables, the

Economy and Stock Prices.- Industry Analysis: Introduction; Business Cycle and Industry Sectors-

Evaluating the industry life cycle- Company Analysis: Analysis of Growth and Value Companies-

Real time online share trading strategies.

UNIT IV TECHNICAL ANALYSIS 9

Introduction- Assumptions, Advantages and Challenges-Dow theory- Charts- Patterns-Market

Indicators- Trend – Moving Averages – Oscillators – Efficient Market theory- Elliot Wave Theory-

Global Inter-market Analysis with the help of Technical Analysis

UNIT V PORTFOLIO MANAGEMENT 9

Portfolio construction, Evaluation, Revision and Diversification- CAPM- Markowitz Model–

Treynor, Sharpe, Jensen and Information Ratios-Asset allocation-International Portfolio Investment

TOTAL: 45 PERIODS

OUTCOMES

After completing the course, the Learners should be able to:

1. Possess good knowledge in the characteristics and objective of investment.

2. Understands various processes involved in securities market.

3. Students would have thorough knowledge in fundamental analysis.

4. Students can able evaluate the technical analysis.

5. Understands the importance of portfolio management.

Curriculum and Syllabus | Master of Business Administration | R2017 Page 62