Page 55 - REC :: MBA CURRICULUM AND SYLLABUS :: R2019

P. 55

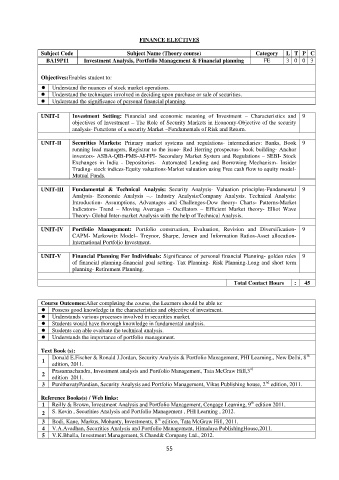

FINANCE ELECTIVES

Subject Code Subject Name (Theory course) Category L T P C

BA19P11 Investment Analysis, Portfolio Management & Financial planning FE 3 0 0 3

Objectives:Enables student to:

Understand the nuances of stock market operations.

Understand the techniques involved in deciding upon purchase or sale of securities.

Understand the significance of personal financial planning.

UNIT-I Investment Setting: Financial and economic meaning of Investment – Characteristics and 9

objectives of Investment – The Role of Security Markets in Economy-Objective of the security

analysis- Functions of a security Market –Fundamentals of Risk and Return.

UNIT-II Securities Markets: Primary market systems and regulations- intermediaries: Banks, Book 9

running lead managers, Registrar to the issue- Red Herring prospectus- book building- Anchor

investors- ASBA-QIB-PMS-AI-FPI- Secondary Market System and Regulations – SEBI- Stock

Exchanges in India - Depositories- Automated Lending and Borrowing Mechanism- Insider

Trading- stock indices-Equity valuations-Market valuation using Free cash flow to equity model-

Mutual Funds.

UNIT-III Fundamental & Technical Analysis: Security Analysis- Valuation principles-Fundamental 9

Analysis- Economic Analysis –.- Industry Analysis:Company Analysis. Technical Analysis:

Introduction- Assumptions, Advantages and Challenges-Dow theory- Charts- Patterns-Market

Indicators- Trend – Moving Averages – Oscillators – Efficient Market theory- Elliot Wave

Theory- Global Inter-market Analysis with the help of Technical Analysis.

UNIT-IV Portfolio Management: Portfolio construction, Evaluation, Revision and Diversification- 9

CAPM- Markowitz Model– Treynor, Sharpe, Jensen and Information Ratios-Asset allocation-

International Portfolio Investment.

UNIT-V Financial Planning For Individuals: Significance of personal financial Planning- golden rules 9

of financial planning-financial goal setting- Tax Planning- Risk Planning-Long and short term

planning- Retirement Planning.

Total Contact Hours : 45

Course Outcomes:After completing the course, the Learners should be able to:

Possess good knowledge in the characteristics and objective of investment.

Understands various processes involved in securities market.

Students would have thorough knowledge in fundamental analysis.

Students can able evaluate the technical analysis.

Understands the importance of portfolio management.

Text Book (s):

th

Donald E.Fischer & Ronald J.Jordan, Security Analysis & Portfolio Management, PHI Learning., New Delhi, 8

1

edition, 2011.

rd

Prasannachandra, Investment analysis and Portfolio Management, Tata McGraw Hill,3

2

edition 2011.

nd

3 PunithavatyPandian, Security Analysis and Portfolio Management, Vikas Publishing house, 2 edition, 2011.

Reference Books(s) / Web links:

th

1 Reilly & Brown, Investment Analysis and Portfolio Management, Cengage Learning, 9 edition 2011.

2 S. Kevin , Securities Analysis and Portfolio Management , PHI Learning , 2012.

th

3 Bodi, Kane, Markus, Mohanty, Investments, 8 edition, Tata McGraw Hill, 2011.

4 V.A.Avadhan, Securities Analysis and Portfolio Management, Himalaya PublishingHouse,2011.

5 V.K.Bhalla, Investment Management, S.Chand& Company Ltd., 2012.

55