Page 28 - ANC20-Proceedings-Presentations-Full

P. 28

Challenges for Indonesian HPAL projects

➔ Indonesian projects similar to Chinese-built Ramu

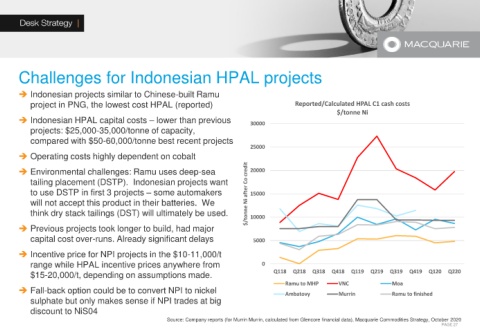

project in PNG, the lowest cost HPAL (reported) Reported/Calculated HPAL C1 cash costs

$/tonne Ni

➔ Indonesian HPAL capital costs – lower than previous 30000

projects: $25,000-35,000/tonne of capacity,

compared with $50-60,000/tonne best recent projects

25000

➔ Operating costs highly dependent on cobalt

➔ Environmental challenges: Ramu uses deep-sea 20000

tailing placement (DSTP). Indonesian projects want

to use DSTP in first 3 projects – some automakers $/tonne Ni after Co credit 15000

will not accept this product in their batteries. We

think dry stack tailings (DST) will ultimately be used. 10000

➔ Previous projects took longer to build, had major

capital cost over-runs. Already significant delays 5000

➔ Incentive price for NPI projects in the $10-11,000/t

range while HPAL incentive prices anywhere from 0

$15-20,000/t, depending on assumptions made. Q118 Q218 Q318 Q418 Q119 Q219 Q319 Q419 Q120 Q220

Ramu to MHP VNC Moa

➔ Fall-back option could be to convert NPI to nickel

Ambatovy Murrin Ramu to finished

sulphate but only makes sense if NPI trades at big

discount to NiS04

Source: Company reports (for Murrin Murrin, calculated from Glencore financial data), Macquarie Commodities Strategy, October 2020

PAGE 27