Page 102 - Learn Africa 2021 Annual Report

P. 102

Learn Africa Plc

Notes to the Financial Statements (cont’d)

For the year ended 31 March 2021

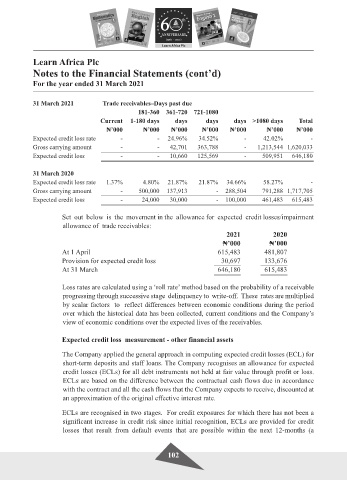

31 March 2021 Trade receivables–Days past due

181-360 361-720 721-1080

Current 1-180 days days days days >1080 days Total

₦’000 ₦’000 ₦’000 ₦’000 ₦’000 ₦’000 ₦’000

Expected credit loss rate - - 24.96% 34.52% - 42.02% -

Gross carrying amount - - 42,701 363,788 - 1,213,544 1,620,033

Expected credit loss - - 10,660 125,569 - 509,951 646,180

31 March 2020

Expected credit loss rate 1.37% 4.80% 21.87% 21.87% 34.66% 58.27% -

Gross carrying amount - 500,000 137,913 - 288,504 791,288 1,717,705

Expected credit loss - 24,000 30,000 - 100,000 461,483 615,483

Set out below is the movement in the allowance for expected credit losses/impairment

allowance of trade receivables:

2021 2020

₦’000 ₦’000

At 1 April 615,483 481,807

Provision for expected credit loss 30,697 133,676

At 31 March 646,180 615,483

Loss rates are calculated using a ‘roll rate’ method based on the probability of a receivable

progressing through successive stage delinquency to write-off. These rates are multiplied

by scalar factors to reflect differences between economic conditions during the period

over which the historical data has been collected, current conditions and the Company’s

view of economic conditions over the expected lives of the receivables.

Expected credit loss measurement - other financial assets

The Company applied the general approach in computing expected credit losses (ECL) for

short-term deposits and staff loans. The Company recognises an allowance for expected

credit losses (ECLs) for all debt instruments not held at fair value through profit or loss.

ECLs are based on the difference between the contractual cash flows due in accordance

with the contract and all the cash flows that the Company expects to receive, discounted at

an approximation of the original effective interest rate.

ECLs are recognised in two stages. For credit exposures for which there has not been a

significant increase in credit risk since initial recognition, ECLs are provided for credit

losses that result from default events that are possible within the next 12-months (a

102