Page 97 - Learn Africa 2021 Annual Report

P. 97

Learn Africa Plc

Notes to the Financial Statements (cont’d)

For the year ended 31 March 2021

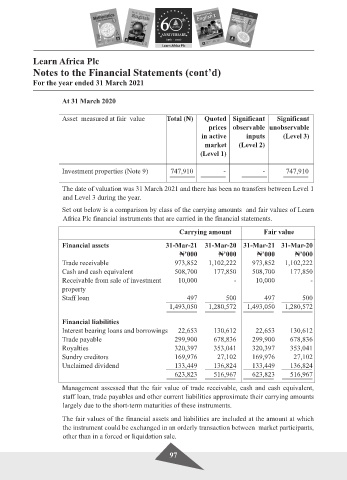

At 31 March 2020

Asset measured at fair value Total (₦) Quoted Significant Significant

prices observable unobservable

in active inputs (Level 3)

market (Level 2)

(Level 1)

Investment properties (Note 9) 747,910 - - 747,910

The date of valuation was 31 March 2021 and there has been no transfers between Level 1

and Level 3 during the year.

Set out below is a comparison by class of the carrying amounts and fair values of Learn

Africa Plc financial instruments that are carried in the financial statements.

Carrying amount Fair value

Financial assets 31-Mar-21 31-Mar-20 31-Mar-21 31-Mar-20

₦’000 ₦’000 ₦’000 ₦’000

Trade receivable 973,852 1,102,222 973,852 1,102,222

Cash and cash equivalent 508,700 177,850 508,700 177,850

Receivable from sale of investment 10,000 - 10,000 -

property

Staff loan 497 500 497 500

1,493,050 1,280,572 1,493,050 1,280,572

Financial liabilities

Interest bearing loans and borrowings 22,653 130,612 22,653 130,612

Trade payable 299,900 678,836 299,900 678,836

Royalties 320,397 353,041 320,397 353,041

Sundry creditors 169,976 27,102 169,976 27,102

Unclaimed dividend 133,449 136,824 133,449 136,824

623,823 516,967 623,823 516,967

Management assessed that the fair value of trade receivable, cash and cash equivalent,

staff loan, trade payables and other current liabilities approximate their carrying amounts

largely due to the short-term maturities of these instruments.

The fair values of the financial assets and liabilities are included at the amount at which

the instrument could be exchanged in an orderly transaction between market participants,

other than in a forced or liquidation sale.

97